How ONEOK Has Managed Its Impressive Dividend Yield

How ONEOK has maintained a 4% yield ONEOK (OKE), the general partner and 41% owner of ONEOK Partners, owns one of the country’s premier natural gas liquid systems. The company’s revenue grew 15% in 2016 after falling 36% in 2015. The growth was driven by its Natural Gas Gathering and Processing, Natural Gas Liquids, and […]

Sep. 11 2017, Published 12:34 p.m. ET

How ONEOK has maintained a 4% yield

ONEOK (OKE), the general partner and 41% owner of ONEOK Partners, owns one of the country’s premier natural gas liquid systems. The company’s revenue grew 15% in 2016 after falling 36% in 2015. The growth was driven by its Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines segments. ONEOK’s operating income rose 29% in 2016 despite higher operating expenses, in sharp contrast to the 13% fall in operating income it saw in 2015.

ONEOK’s earnings per share

ONEOK’s EPS (earnings per share) rose 43% in 2016 despite a 13% interest expense rise. In 2015, its EPS fell 22%, and its interest expenses rose 17%. The company recorded positive free cash flow in 2016, driven by operating cash flow and lower capital expenditure.

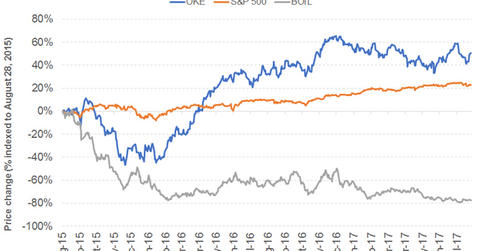

ONEOK recorded a debt-to-equity ratio of 42x in 2016. Whereas the company’s stock outperformed the oil and gas midstream industry and the S&P 500 by a wide margin in 2016, it has barely managed positive returns this year and has been beaten by the S&P 500.

Impressive dividend yield decoded

The company recorded a 40% revenue growth in 1H17 and almost flat operating income. Its EPS fell 8%. Its dividend yield fall was due to stock price appreciation. The PowerShares International Dividend Achievers ETF (PID) is diversified across sectors and geographies. It has a substantial stake in Europe and energy. The ETF offers a dividend yield of 3.6%, at a PE (price-to-earnings) ratio of 15.1x. It has a 3% exposure to small-cap stocks. The ProShares S&P 500 Aristocrats ETF (NOBL) has a substantial stake in the consumer non-cyclical space. It offers a dividend yield of 1.9%, at a PE ratio of 21x. The ETF does not have any exposure to small caps.