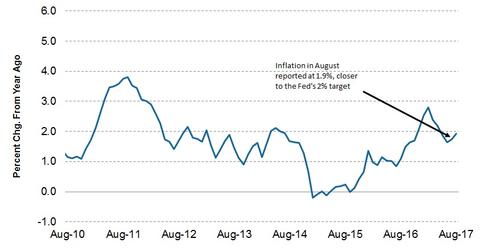

Is the Uptick in August Inflation Enough for a Fed Hike in December?

Slow US inflation growth has been a concern for the US Fed and was one of the key reasons that the Fed raised interest rates only twice in 2017.

Sept. 20 2017, Updated 8:07 a.m. ET

A close look at US inflation

Slow US inflation growth has been a concern for the US Fed and was one of the key reasons that the Fed raised interest rates only twice in 2017. The recent post-meeting statements indicated that there could be further delays in achieving the 2% inflation target. Consumer price inflation (or CPI) (TIP) data for August was encouraging. CORE CPI, which excludes food and energy prices, as they are volatile, rose 0.2% month-over-month, the best since February this year. CPI (VTIP), on the other hand, rose 1.9% in August, closer to the 2% target rate.

Why does the Fed want inflation to improve?

The rise in prices is measured by inflation (STIP). So why is the Fed wanting prices to rise? To understand this, let’s assume that the prices are falling. If a customer is planning on a purchase and is aware that prices are falling, it would make sense for the customer to wait. Imagine this scenario for all the products being sold. There would be limited purchases, which in turn will lead to lower demand. As a chain reaction, companies produce less and hire fewer employees, leading to rising unemployment. This becomes a vicious cycle finally leading to a recession.

How could the Fed react?

The optimal level of inflation (SCHP), as determined by the US Fed, is around 2% along with an unemployment rate below 4.5%. The uptick in August inflation (TDTT) could give ammunition for the Fed hawks to warrant a rate hike, or at least leave the possibility open. In the September meeting, the Fed could leave the rates unchanged, but the option to raise rates in December could be left open.

In the next part of this series, we’ll understand the balance sheet unwinding program that the Fed could announce at its September meeting.