Inside Baxter International’s Stock Price Performance

On September 7, 2017, BAX stock closed at $62.84 per share. It has a 50-day moving average of $61.15 and a 200-day moving average of $57.14.

Sept. 11 2017, Updated 9:07 a.m. ET

BAX’s stock performance

Baxter International (BAX) is a leading medical device company in the US that offers renal and hospital products to healthcare companies. The company’s stock has gained significant growth momentum after seeing lows in December 2016.

On September 7, 2017, BAX stock closed at $62.84 per share. It has a 50-day moving average of $61.15 and a 200-day moving average of $57.14. The company reported its 52-week high of $63.14 on July 21, 2017. Its 52-week low was $43.13 on December 7, 2016.

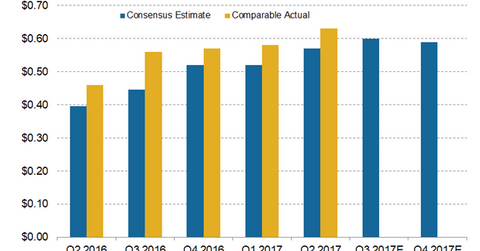

Baxter International reported strong 2Q17 earnings results on July 26, 2017. The company’s results exceeded the Wall Street analysts’ estimates, and in pre-market trading that day, BAX stock was trading 1.2% higher. Since then, BAX stock has gained ~1.3%.

Comparisons with industry and market performances

YTD (year-to-date), Baxter International has gained nearly 41.7%, compared with the S&P 500 Index, which has returned ~10.1% over the same period. The iShares US Medical Devices (IHI) has gained ~26% YTD.

Over the past year, BAX stock has returned ~36%, which is well ahead of the market and industry returns of around 13% and 16.4%, respectively, over the past 12 months.

As of September 8, 2017, peers Thermo Fisher Scientific (TMO), Boston Scientific (BSX), and Abbott Laboratories (ABT) have generated returns of 26%, 17.7%, and 22.3%, respectively, over the past year.