How Are Novartis’s Blockbuster Drugs Gleevec and Tasigna Positioned?

In 1H17, Novartis’s (NVS) Gleevec reported revenues of around $1.1 billion, which reflected a ~39% decline on a year-over-year (or YoY) basis.

Sept. 19 2017, Updated 9:10 a.m. ET

Gleevec revenue trends

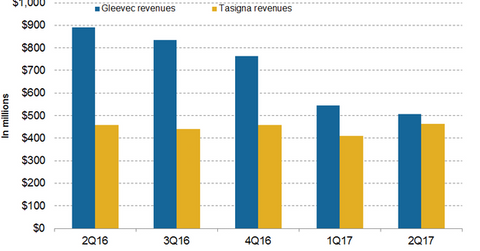

In 1H17, Novartis’s (NVS) Gleevec reported revenues of around $1.1 billion, which reflected a ~39% decline on a year-over-year (or YoY) basis. In 2Q17, Gleevec generated revenues of around $506 million, a ~43% decline on a YoY basis and a 7% decline on a quarter-over-quarter basis. Competition from the generic versions of imatinib in the US and European markets was the primary reason for the drug’s declining revenues.

Tasigna revenue trends

In 1H17, Tasigna generated revenues of around $874 million, which is ~4% growth on a YoY basis. In 2Q17, Tasigna generated revenues of around $463 million, which is ~1% growth on a YoY basis and ~13% growth on a quarter-over-quarter basis. The growth in sales in the US and emerging markets primarily contributed to the revenue growth in 2Q17.

Recent approval

In June 2017, the European Commission (or EC) approved the addition of Treatment-Free Remission (or TFR) statistics in the Tasigna Summary of Product Characteristics (or SmPC). TFR statistics demonstrate that individuals in the chronic phase of Philadelphia chromosome-positive (or Ph+) chronic myeloid leukemia (or CML) have maintained a molecular response after stopping of tyrosine kinase inhibitor (or TKI) therapy.

The EC approval of Tasigna was based on safety and efficacy results from the ENESTfreedom and ENESTop trial. The ENESTfreedom and ENESTop trial demonstrated that more than 50% of individuals with Ph+ CML-CP who met the predefined response criteria of the trials (both in the first-line setting and after switching from Glivec) were able to uphold TFR after discontinuing Tasigna.

Novartis’s Tasigna competes with Bristol-Myers Squibb’s (BMY) Sprycel, Ariad Pharmaceuticals’ Iclusig, and Pfizer’s (PFE) Bosulif. Takeda Pharmaceuticals (TKPYY) acquired Ariad Pharmaceuticals in February 2017. The growth in sales of Novartis’s Tasigna could boost the Vanguard Total International Stock ETF (VXUS). Novartis makes up about ~0.79% of VXUS’s total portfolio holdings.