A Correlation Study of Mining Stocks in September 2017

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD basis, while Sibanye Gold has the lowest correlation to gold.

Sept. 13 2017, Updated 9:07 a.m. ET

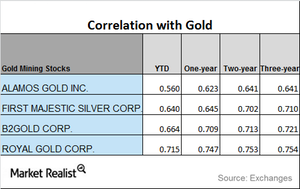

Miners’ correlations with gold

In this part of the series, we’ll look at mining stocks’ correlations with precious metals by comparing their price movements. Specifically, we’ll analyze Sibanye Gold (SBGL), Gold Fields (GFI), Primero Mining (PPP), and Franco-Nevada (FNV).

Mining stocks have recovered in the past few weeks. The leveraged mining fund, the Direxion Daily Gold Miners Bull 3X ETF (NUGT), and the ProShares Ultra Silver (AGQ) have risen 6.1% and 4.5%, respectively, on a 30-day trailing basis.

Correlation trends

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD (year-to-date) basis, while Sibanye Gold has the lowest correlation to gold.

Sibanye Gold, Gold Fields, and Primero Mining have seen upward scaling correlations to gold over the past three years. Franco-Nevada has seen a mixed correlation to gold.

Gold Fields saw its three-year correlation rise from 0.77 to a one-year correlation of 0.80. A correlation of 0.80 suggests that about 80.0% of the time, Gold Fields has moved in the same direction as gold.

A correlation study of miners is crucial since the movement of the stocks can be studied by way of fluctuations in precious metals.