Why Amazon Has Lagged behind in China

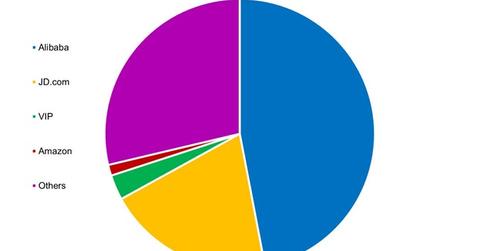

According to Euromonitor, Alibaba and JD.com make up two-thirds of the Chinese online retail market.

Aug. 31 2017, Updated 10:38 a.m. ET

Amazon Prime Membership hasn’t taken off in China

For years, Amazon (AMZN) has struggled to penetrate the Chinese market, which is dominated by Alibaba (BABA) and JD.com (JD). The company unveiled its Amazon Prime membership in China in October 2016 in a bid to finally crack the dominance of these local players.

However, Amazon Prime wasn’t successful in its initial effort. The popular streaming video content that comes with the membership isn’t available in China due to censorship rules.

Why Amazon finds it difficult to penetrate the Chinese market

Amazon (AMZN) joins a long list of American tech companies—including Facebook (FB), Apple (AAPL), Alphabet (GOOG), and Microsoft (MSFT)—that have been relatively unsuccessful in tapping into the world’s second-largest economy.

This trend was due to a combination of strict control by the Chinese authorities and local competitors that offer similar products at lower costs. For example, Apple’s market share fell in China due to the rise of Chinese manufacturers like Oppo, Vivo, Huawei, and Xiaomi.

According to Euromonitor, Alibaba and JD.com make up two-thirds of the Chinese online retail market. Meanwhile, Amazon makes up just 1.3% of that market. Walmart (WMT) now has an 11% stake in JD.com.

Amazon has fallen behind Alibaba and JD.com due to its mobile platform. Alibaba and other local companies offer a popular mobile shopping platform, including discounted deals for consumers. On the other hand, Amazon offers minimal offers and features on its Chinese mobile platform, which is not attractive for Chinese consumers.

According to BCG estimates, smartphone-based online shopping could account for more than 60% of the total Chinese online retail market.