What’s behind Medtronic’s Accelerating Margin Expansion?

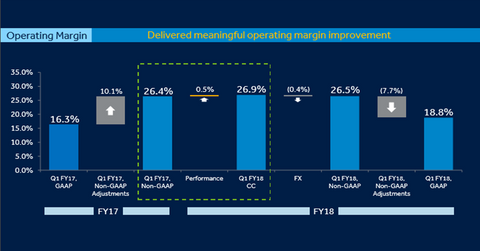

In fiscal 1Q18, Medtronic (MDT) reported ~26.9% of operating margin on a constant currency basis. This represented year-over-year growth of ~50 basis points.

Sept. 4 2017, Updated 7:36 a.m. ET

Medtronic’s margin growth

In fiscal 1Q18, Medtronic (MDT) reported ~26.9% of operating margin on a constant currency basis. This represented year-over-year growth of ~50 basis points. On an organic basis, Medtronic recorded an operating margin expansion of approximately 70 basis points in fiscal 1Q18.

Peers Becton, Dickinson and Co. (BDX), Stryker (SYK), and Boston Scientific (BSX) registered operating margins of approximately -7.3%, 16.6%, and -60.0%, respectively, in their recently ended quarters. Medtronic accounts for ~1.2% of the total holdings of the iShares S&P 500 Value ETF (IVE).

Drivers of operating margin expansion

Medtronic’s margin improvements in fiscal 1Q18 were partly driven by the efficiencies resulting from the effective delivery of the Covidien synergies. However, the sales and marketing expenditures by the company to support its new product launches through the rest of the year negatively impacted the company’s margins in the quarter.

The company’s net other expenses increased in fiscal 1Q18 compared to fiscal 1Q17. This trend was due to the expenses related to the hedging program and the remeasurement of the foreign exchange impact. Going forward, this expenditure is expected to be ~$110 million in each quarter. In fiscal 2Q18, this expenditure is expected to be slightly higher than this estimate.

The weakness in general surgery volumes led to subdued MITG (Minimally Invasive Therapies Group) sales, which also impacted margins in the quarter. The priority access program affected the revenues and margins of Medtronic in fiscal 1Q18. Only a part of its deferred revenues were recognized as the company exchanged its customers’ 630G systems with the updated 670G systems.

Medtronic expects a stronger margin in fiscal 2H18 driven by lower SG&A (sales, general, and marketing) expenses and eased diabetes supply constraints. The ongoing sensor annuity revenues could have a positive impact on the company’s performance in fiscal 2H18.

The Cardinal Health divestiture, as we discussed in the previous article, is also expected to yield modest earnings growth in the near term and better revenues and margins in the long term.

In the next article, we’ll discuss Medtronic’s product pipeline.