Under Armour Faces Target Price Cuts

Wall Street’s reaction to 2Q17 earnings Under Armour’s (UAA) 2Q17 results were followed by a host of analyst actions, ranging from target price cuts to downward revisions. The stock’s target price was revised by UBS (from $21 to $19), Canaccord Genuity (from $21 to $18), Stifel (from $19 to $18), Wedbush (from $18 to $17), […]

Aug. 31 2017, Updated 6:56 p.m. ET

Wall Street’s reaction to 2Q17 earnings

Under Armour’s (UAA) 2Q17 results were followed by a host of analyst actions, ranging from target price cuts to downward revisions. The stock’s target price was revised by UBS (from $21 to $19), Canaccord Genuity (from $21 to $18), Stifel (from $19 to $18), Wedbush (from $18 to $17), Telsey Advisory (from $21 to $18), Barclays (from $22 to $20), D.A. Davidson (from $28 to $20), Cowen (from $19 to $18), JPMorgan Chase (from $19 to $18), and Deutsche Bank (from $17 to $16). All of these brokers’ recommendations remained the same.

However, Citigroup downgraded UAA to “neutral” from “buy,” citing a tough near-term outlook as the reason for the downgrade. Analyst Kate McShane lowered the stock’s target price from $25 to $21. UAA has an average price target of $20.27, down from the $21.57 it stood at before the company’s 2Q17 results. However, it still has an upside of 9% over the next 12 months.

Wall Street recommendations

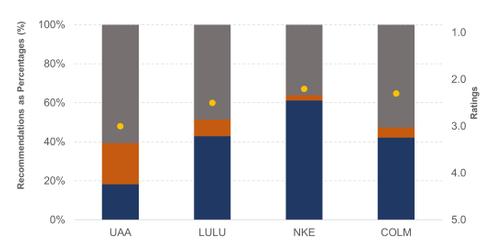

UAA, which is covered by 33 analysts, has received “hold” recommendations from two-thirds of the analysts covering it. UBS, Wedbush, and Citigroup are among the brokerage houses that suggest holding the stock.

While 18% of analysts suggest buying UAA, 21% recommend selling it. UAA has the highest percentage of “sell” ratings in its peer group. In comparison, Nike (NKE), Lululemon Athletica (LULU), and Columbia Sportswear (COLM) have been rated as “sell” by 3%, 9%, and 5% of analysts, respectively.

Ratings

UAA’s rating has also deteriorated after the company’s 2Q17 results. The stock stands at 3 on a scale of 1 (strong buy) to 5 (sell). It stood at 2.9 before the result announcement. At the beginning of the year, the company had a strong rating of 2.3, in line with peers Nike, Columbia, and Lululemon, which had ratings of 2.2, 2.3, and 2.5, respectively. Investors seeking exposure to Under Armour could consider the PowerShares S&P 500 High Beta Portfolio ETF (SPHB), which invests 0.8% of its portfolio in the company.