Under Armour Beats Top- and Bottom-Line Expectations

Baltimore-based Under Armour (UAA) reported its 2Q17 results on Tuesday, August 1. This series is an overview of Under Armour’s 2Q17 results.

Aug. 31 2017, Updated 6:56 p.m. ET

Under Armour’s 2Q17 results overview

Baltimore-based Under Armour (UAA) reported its 2Q17 results on Tuesday, August 1. The results relate to the three-month period ended June 30, 2017.

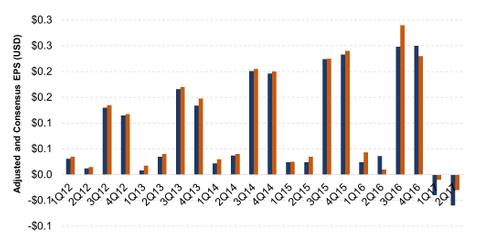

The company posted 8.7% growth in revenue to $1.1 billion, beating estimates by $11 million. Its bottom line was in the red in 2Q17, at -$0.03 per share, compared with $0.01 per share in 2Q16. However, Under Armour beat the Wall Street expectation of -$0.06 per share.

Despite beating earnings and revenue estimates, Under Armour saw its stock price fall 8.6%, touching its four-year low of $18.30 on August 1. This decline was a result of Under Armour trimming its sales forecast, announcing job cuts, and closing stores. Investors seeking exposure to Under Armour could consider the PowerShares S&P 500 High Beta Portfolio ETF (SPHB), which invests 0.8% of its portfolio in the company.

Valuation update and stock recommendation

Under Armour’s stock is currently trading at a one-year forward price-to-earnings ratio of 43x, compared with its three-year average of 65x. However, it continues to be more expensive than Nike (NKE), Columbia Sportswear (COLM), and Lululemon Athletica (LULU), which had ratios of 25x, 21x, and 26x, respectively.

The average 12-month price target given by the 33 analysts covering Under Armour is $20.27, indicating an upside of 9% over the next year. Six of the 33 analysts have recommended “buy,” 20 have recommended “hold,” and seven analysts have recommended “sell.”

In this series

This series is an overview of Under Armour’s 2Q17 results. We’ll discuss the company’s financial performance during the quarter by evaluating its key revenue drivers and profitability, Wall Street’s views on Under Armour, its stock market performance, and the company’s current valuation.