Which Stocks Will Benefit the Most from US-Korea Tensions?

Some companies benefit in times of uncertainty, and some sectors provide cover for investors.

Aug. 14 2017, Updated 9:36 a.m. ET

Volatility on the rise again

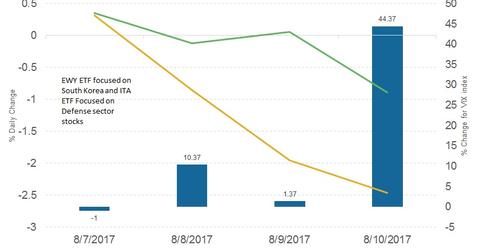

Tensions between the United States and North Korea have escalated in recent weeks after fresh sanctions were imposed on North Korea. These sanctions would have a drastic impact on North Korea’s export revenue. President Trump’s “fire and fury” warning came next, and what followed was shaken confidence in the financial markets and a rise in volatility around the world. The CBOE Volatility Index (or VIX) (VXX), which is considered a fear gauge, shot up from its multi-decade lows below 10.0 to 16.0 by the close of business on August 10, 2017. That rise in volatility (VIXY) indicates that investors are beginning to fear the consequences of further escalation between the United States and North Korea.

Defense stocks in focus

It’s important to remember that some companies benefit in times of uncertainty, and some sectors provide cover for investors. We’re talking about the defense and defensive sectors. Demand for companies in the defense sector (ITA) goes up in times of escalating geopolitical tensions, and some companies retain their value. Examples of sectors that are part of the defensive sector include healthcare (VHT) and consumer staples (XLP). Demand for these industries remains stable even in negative economic business cycles.

What’s next for the stock market

It’s too early to tell if this sudden explosion of volatility is a threat to the stock market. If nothing else happens between the United States and North Korea in the next few days, we can expect a slowdown in volatility. It’s difficult to predict the actions of governments, but it’s best to remain prepared. In the next part of this series, we’ll analyze the recent performances of safe havens.