North America: Fresenius Medical Care’s Major Target Market in 2017

In 2Q17, Fresenius Medical Care (FMS) reported revenues close to 3.3 billion euros, which represents year-over-year growth of ~11%.

Aug. 18 2017, Updated 7:37 a.m. ET

North American market

In 2Q17, Fresenius Medical Care (FMS) reported revenues close to 3.3 billion euros, which represents year-over-year (or YoY) growth of ~11%. The company witnessed 5% YoY organic growth in this market, driven mainly by the robust performance of its Care Coordination segment.

In 2Q17, North America comprised ~72% of Fresenius Medical Care’s total revenues. Fresenius Medical Care’s competitors in the North American diagnostic space include DaVita (DVA), Laboratory Corporation of America Holdings (LH), and Quest Diagnostics (DGX).

Fresenius Medical Care (FMS) comprises ~0.46% of the holdings of the PowerShares International Dividend Achievers Portfolio ETF (PID).

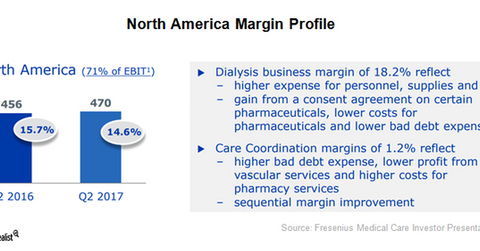

The chart above shows the margins of the Fresenius Medical Care’s North American business, which dropped 110 basis points YoY in 2Q17, driven mainly by bad debt expenses from the Care Coordination business.

Services and products contribution

In 2Q17, Fresenius Medical Care (FMS) reported revenues close to 3.0 billion euros for its North American Health Care Services business, which represents 11% growth on a reported basis and 8% growth on a constant currency basis. In 2Q17, the company saw 6% YoY organic growth and 3% same-market growth in its North American Services business in 2Q17.

The North American market also contributed ~698 million euros to FMS’s Care Coordination segment’s revenues in 2Q17. This implied YoY growth of ~32% on a reported basis and 29% on a constant currency basis.

The Care Coordination segment reported 19% YoY organic growth in the North American market in 2Q17. The North American market contributed ~83% of the company’s total 2Q17 Healthcare Services sales.

In 2Q17, Fresenius Medical Care reported revenues close to 208 million euros for its North American Health Care Products business, which represents 2% YoY growth on a reported basis and 0% on a constant currency basis.

In 2Q17, FMS reported increased sales of peritoneal dialysis products as well as disposables for hemodialysis in North America. The North American market contributed ~25% to the company’s total 2Q17 Healthcare Products sales.

In the next part of this series, we’ll discuss the growth trends of Fresenius Medical Care’s Dialysis Products business.