Fresenius Medical Care AG & Co. KGaA

Latest Fresenius Medical Care AG & Co. KGaA News and Updates

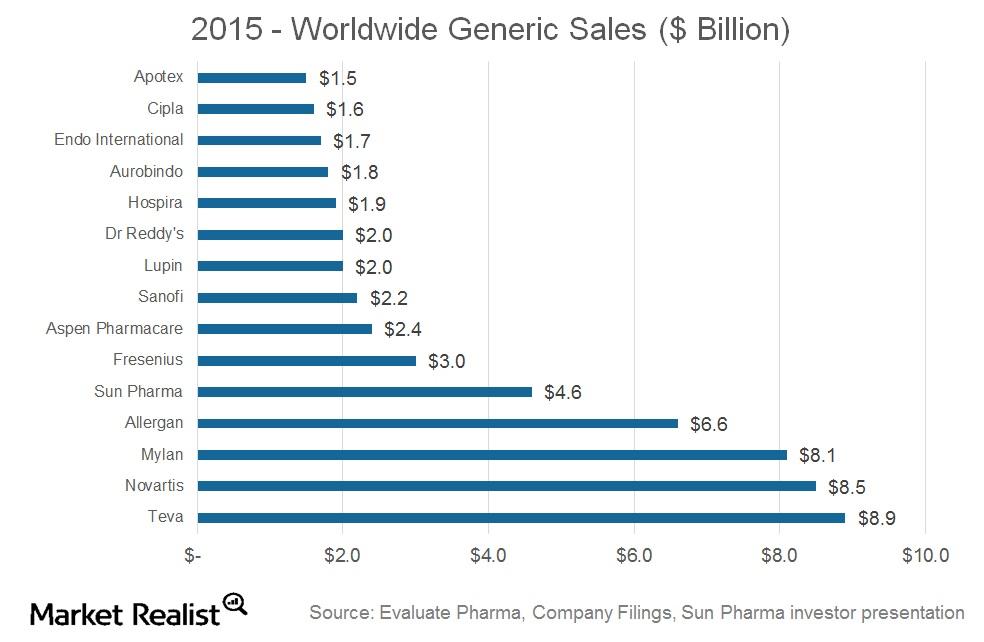

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 1)

Market Realist analysts recently conducted a Q&A with experts from VanEck on the generic pharmaceutical industry, a space that has attracted investor interest due to upside potential from brand name drugs coming off patent, cost saving pressure in the healthcare industry, and increased worldwide demand for prescription drugs (for more on these topics, please see […]

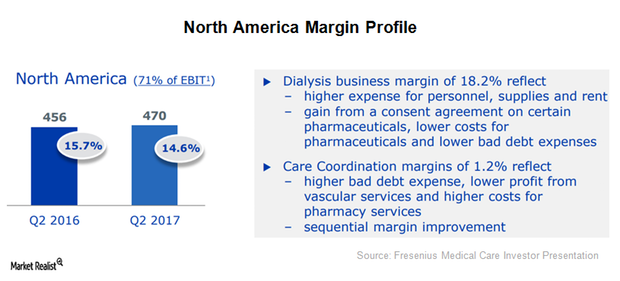

North America: Fresenius Medical Care’s Major Target Market in 2017

In 2Q17, Fresenius Medical Care (FMS) reported revenues close to 3.3 billion euros, which represents year-over-year growth of ~11%.