Medtronic’s Emerging Market Position and Opportunities for Fiscal 2018

Medtronic (MDT) registered revenues of ~$1.0 billion revenues from emerging markets in fiscal 1Q18, which represents YoY (year-over-year) sales growth of ~11% in that market.

Sept. 1 2017, Updated 7:37 a.m. ET

Medtronic’s emerging market footprints

Medtronic (MDT) registered revenues of ~$1.0 billion from emerging markets in fiscal 1Q18, which represents YoY (year-over-year) sales growth of ~11% in that market. This double-digit growth was driven by strong performances in China, Southeast Asia, the Middle East, Africa, and Latin America.

Medtronic has a long-term goal of double-digit sales growth, which is being accelerated through diversification and expansion across the emerging markets. Latin America recorded ~16% sales growth in the quarter with strong performances in Brazil, Chile, Mexico, and Argentina. China saw ~12% growth and continued improvement in its sales momentum.

The Middle East registered sales growth of ~12% as the headwinds from Saudi Arabia have begun to stabilize and the company registered the first quarter of sales growth in the region in the last six quarters. Vietnam, Thailand, and Indonesia registered robust sales in the Southeast Asia region, which also registered double-digit growth in the quarter.

Emerging market growth opportunities

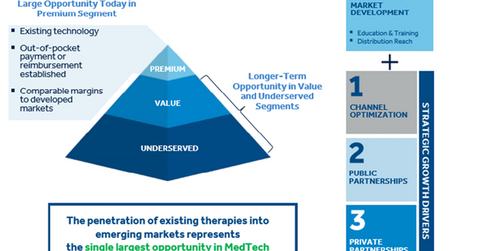

Medtronic (MDT) believes the largest untapped opportunity in the emerging markets lies in its Premium segment. However, the long-term value would be realized through its Value and Underserved segments.

The company has been undertaking initiatives to expand its distribution reach in emerging markets, as well as establishing education and training centers through public and private partnerships.

Existing therapy penetration is expected to be a major medtech opportunity in emerging markets over the long term. Market-specific product strategies are being implemented by the company in these markets to efficiently establish its presence and accelerate growth across these regions.

Peers Becton, Dickinson and Co. (BDX), Abbott Laboratories (ABT), and Stryker (SYK) are among the largest medtech companies looking to tap the emerging market opportunity, and they are accelerating their growth strategies to expand in these markets.

Investors looking for exposure to Medtronic can invest in the SPDR S&P 500 ETF (SPY), which holds ~0.52% of its portfolio in Medtronic.

In the next part of this series, we’ll look at the progress related to the realization of its Covidien synergies.