Emersion Electric’s Dividend Woes

Emersion Electric’s (EMR) 2016 net sales fell 11.0% due to a fall in every segment.

Aug. 16 2017, Published 9:40 a.m. ET

Emersion Electric: Industrial goods sector, industrial electrical equipment industry

Emersion Electric’s (EMR) 2016 net sales fell 11.0% due to a fall in every segment, including Process Management, Industrial Automation, Climate Technologies, and Commercial & Residential Solutions. The company’s EPS (earnings per share) fell sharply due to its top-line performance, gains recorded on divestments in 2015, and rising interest expenses. The company generates enough free cash flow to honor its dividend commitments. Share repurchases declined in 2016. Its financial leverage has seen an increasing trend. A reasonable debt-to-equity ratio has been maintained.

The company realigned its business segments in 2017. The new Automation Solutions segment includes Process Management and the remaining businesses of Industrial Automation, except the hermetic motors business, which will be part of Climate Technologies. Commercial & Residential Solutions includes Climate Technologies and Tools & Home Products, which includes Commercial & Residential Solutions.

Emerson Electric expects 2017 to be quite challenging for its automation businesses, driven by weak economic growth and political uncertainty. Commercial & Residential Solutions is expected to receive support from global HVAC (heating, ventilation, and air conditioning) and the US construction markets.

The dividend yield has remained above the 3.0% mark, as you can see in the graph below. (Note that the asterisk in the graph denotes an approximation in calculating the dividend.)

Net sales

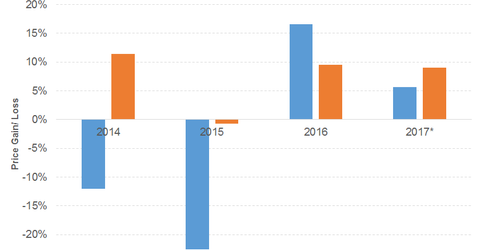

Emerson Electric’s net sales for the first nine months of 2017 rose 2.0%, driven by Commercial & Residential Solutions. Growth was recorded in both segments in 3Q17. EPS fell due to the loss from discontinued operations. (Note that the asterisk in the graph denotes the price gain or loss to date.)

We can see that prices have finally moved north after two years of moving south. The weakness in sales and EPS is the main reason behind the underperformance of the stock compared to the S&P 500 in 2017. Emerson Electric fell below peers such as Illinois Tool Works (ITW), as you can see in the graph below.

EMR stock has risen 3.4% on a YTD (year-to-date) basis.

Emerson Electric’s PE (price-to-earnings) ratio of 24.0x compares to a sector average of 27.7x. The company’s dividend yield of 3.3% compares to a sector average of 1.9%.