Illinois Tool Works Inc

Latest Illinois Tool Works Inc News and Updates

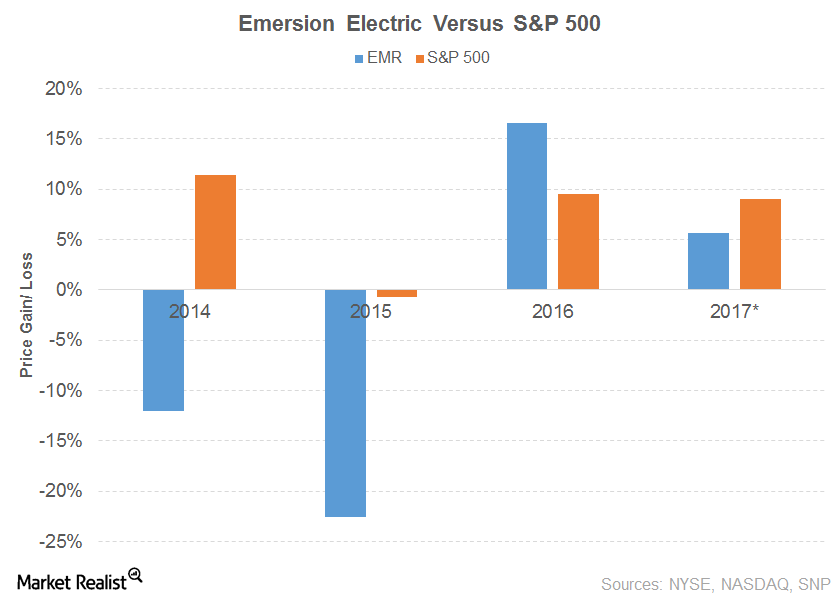

Emersion Electric’s Dividend Woes

Emersion Electric’s (EMR) 2016 net sales fell 11.0% due to a fall in every segment.

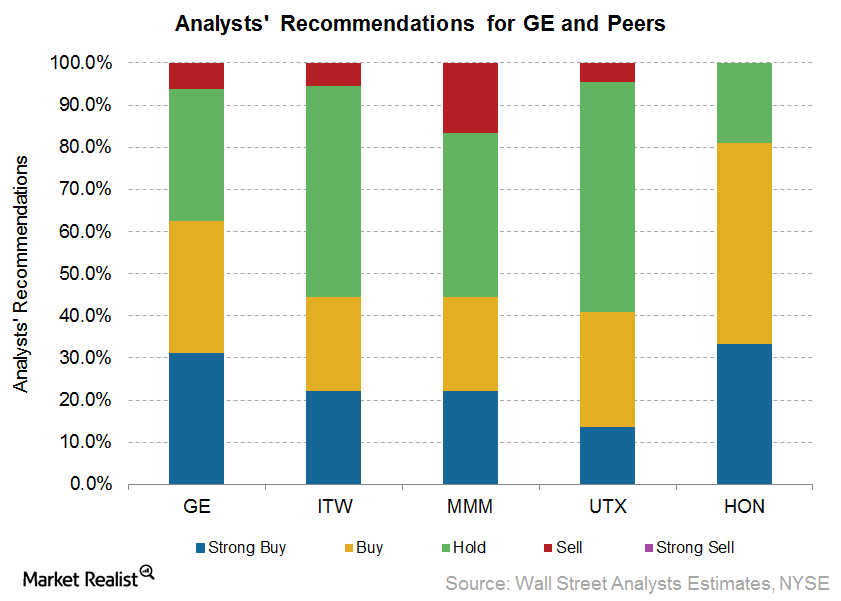

How Analysts View General Electric Leading Up to 1Q17

In this article, we’ll review analysts’ recommendations for General Electric (GE) ahead of its 1Q17 earnings release on April 21, 2017. Wall Street analysts seem to be divided over GE.

Has Lincoln Electric Outperformed Its Peers?

For fiscal 2015, Lincoln Electric (LECO) successfully gave back $486 million to its shareholders.