WisdomTree U.S. Quality Dividend Growth Fund

Latest WisdomTree U.S. Quality Dividend Growth Fund News and Updates

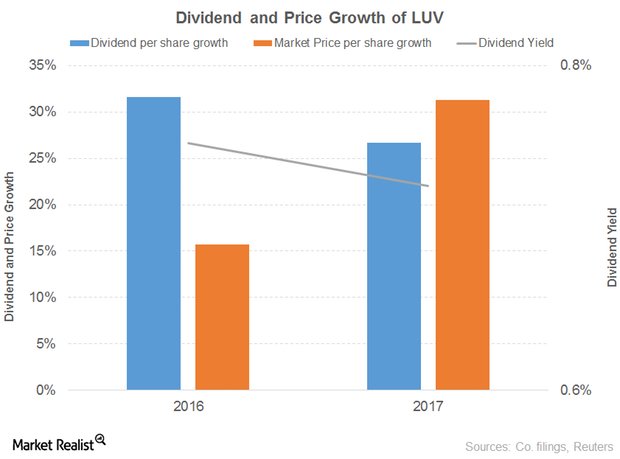

Here’s What Influenced the Outlook for Southwest Airlines

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

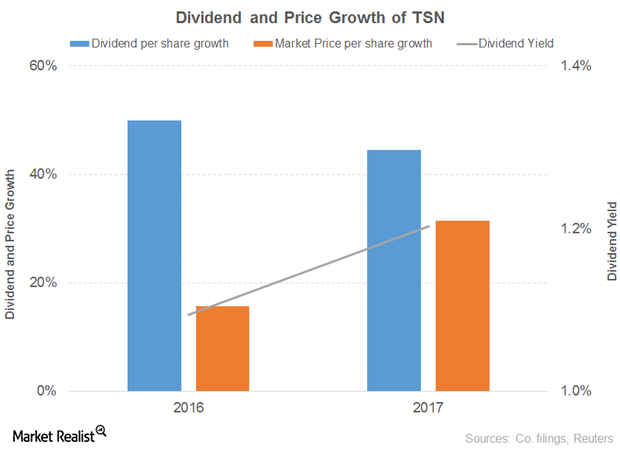

What’s the Outlook for Tyson?

Tyson Foods’ (TSN) sales dropped 11% in 2016 before gaining 4% in 2017.

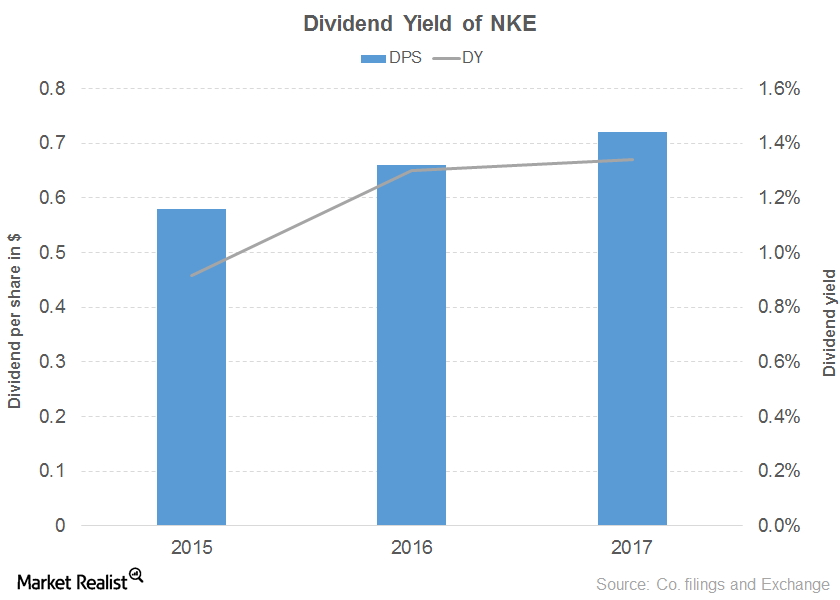

A Look at Nike’s Dividend Yield Curve

Nike’s (NKE) operating income rose 5.0% in 2017 compared to 8.0% in 2016 due to higher expenses and lower gross margins.

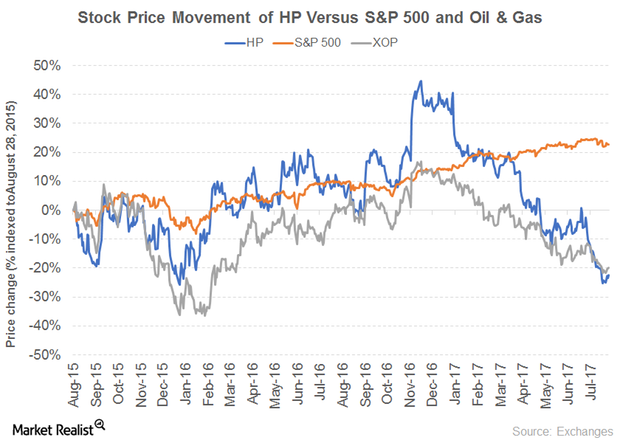

Decoding Helmerich & Payne’s Dividend Yield

What’s driving Helmerich & Payne’s high yield? Contract oil and gas well driller Helmerich & Payne (HP) recorded a sharp drop in its 2016 operating revenue due to declines in its US drilling, offshore, and international segments. Its revenue fell 19% in 2015, compared with 51% in 2016. Its operating income, as a result, ended […]

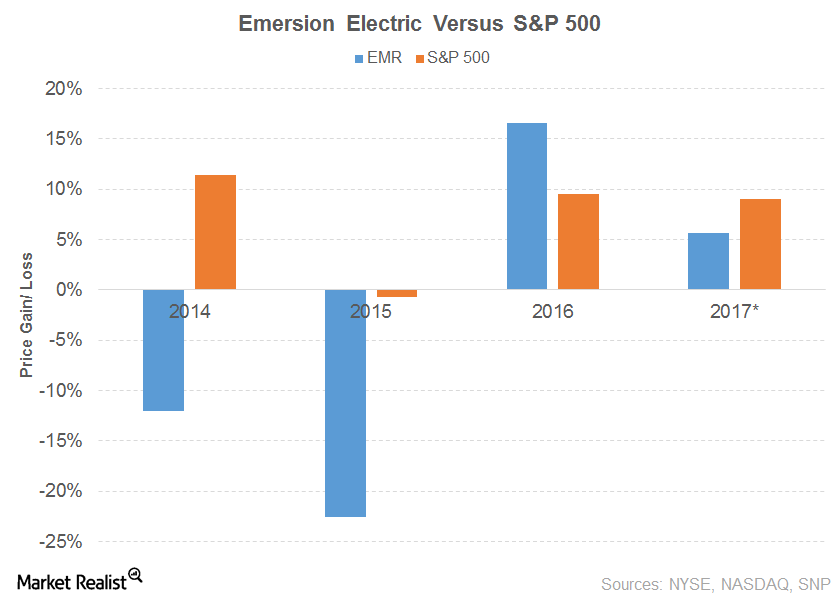

Emersion Electric’s Dividend Woes

Emersion Electric’s (EMR) 2016 net sales fell 11.0% due to a fall in every segment.

IBM’s Dividend Growth Curve

For IBM (IBM), 1Q17 marked the 22nd year of annual dividend growth despite being the 20th successive quarter with no revenue growth.