Dividend Yield of Stanley Black & Decker

Stanley Black & Decker’s (SWK) PE ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%.

Aug. 23 2017, Published 12:43 p.m. ET

Stanley Black & Decker: Industrial goods sector, machine tools, and accessories industry

Stanley Black & Decker (SWK) manufactures industrial tools and household hardware and provides security products. Revenues for fiscal 2016 recorded growth, driven by the tolls and storage and security segments, partially offset by the industrial segment. EPS (earnings per share) recorded impressive growth despite higher operating and interest expenses. The company is also involved in share buybacks.

Revenue for the first half of 2017 posted growth, driven by the tools and storage and industrial segments, partially offset by the security segment. EPS recorded growth, mainly due to a gain from the sale of a business.

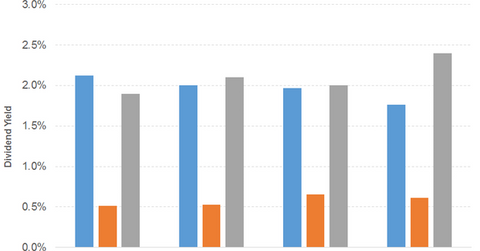

In the graph below, we can see Stanley Black & Decker’s dividend yield compared to the S&P 500 and Roper Technologies (ROP). (The asterisk in the graph denotes an approximation in calculating dividend yield.)

Dividend increases for 50 years

Stanley Black & Decker (SWK) has increased its dividends annually for the last 50 years. Its free cash flow has also increased in 2016. The company’s dividend yield has fallen over the years and is currently lower than the S&P 500.

The company’s PE (price-to-earnings) ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%. In the graph below, we can see Stanley Black & Decker’s price movement compared to the S&P 500 and Roper Technologies.

Stanley Black & Decker raised its 2017 EPS outlook from $7.95–$8.15 to $8.05–$8.25, driven by higher organic growth potentials.

During 2016, the company completed five small acquisitions that were integrated into the tools and storage and security segments. It also acquired the tools business of Newell Brands, the Craftsman brand from Sears Holdings, and two smaller acquisitions pertaining to the company’s security segment in 2017.

The PowerShares International Dividend Achievers ETF (PID) offers a dividend yield of 3.7% at a PE ratio of 15.1x. The geographically diversified ETF has a substantial exposure to energy. The ALPS Sector Dividend Dogs ETF (SDOG) offers a dividend yield of 3.5% at a PE ratio of 16.3x. It’s a diversified ETF.