US Steel Prices: The Outlook for Cliffs Natural Resources

Cliffs Natural Resources (CLF) downgraded its EBITDA and net earnings guidance for 2017 due to weaker-than-expected YTD averages of US HRC and seaborne iron ore prices.

Aug. 4 2017, Updated 10:37 a.m. ET

Steel supply and demand

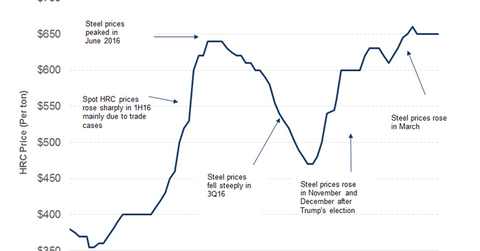

Similar to the determination of prices of other commodities, steel prices depend on steel supply and demand dynamics. US steel prices began an upward arch following higher anti-dumping duties, leading to lower imports in 2016. The development gave pricing power to US steelmakers, resulting in higher steel prices.

CLF’s take on steel prices

Cliffs Natural Resources (CLF) downgraded its EBITDA (earnings before interest, tax, depreciation, and amortization) and net earnings guidance for 2017 due to weaker-than-expected YTD (year-to-date) averages of US HRC (hot-rolled coil) and seaborne iron ore prices. It assumes YTD averages of $70 per ton for iron ore and $620 per ton for US HRC to prevail for the remainder of the year for the purpose of guidance.

However, CLF believes that HRC prices should improve in the second half of 2017 since steel demand continues to improve. CLF’s CEO (chief executive officer) Lourenco Goncalves said during the 2Q17 earnings call that panic buying from service centers and other steel consumers could drive steel prices higher as these consumers start to understand the threat of Section 232.

Outlook

U.S. Steel’s (X) guidance assumes steel prices of $610 per ton. US steel companies (NUE) have been pushing for price hikes over the last couple of weeks. It will be interesting to see if the hikes could hold as we enter the seasonally weak second half of the year. Also, as we saw previously, recent comments from the U.S. Secretary of Commerce have dashed the hopes of a strong trade relief, at least in the very immediate period. As a result, we could see some moderation in US steel prices in 3Q17. However, if the Trump administration imposes tariffs, it could lead to an earnings upside for steelmakers (SLX) such as AK Steel (AKS) and Nucor (NUE).

After looking at the supply and demand scenario in the United States, let’s analyze the seaborne iron ore supply and demand. That could significantly affect Cliffs Natural Resources’ fortunes.