What Cliffs Natural Resources’ Debt Tender Offer Means

On July 31, 2017, Cliffs Natural Resources (CLF) announced a tender offer for a $575.0 million aggregate principal amount of its 5.75% guaranteed notes due in 2025.

Nov. 20 2020, Updated 2:20 p.m. ET

The tender offer

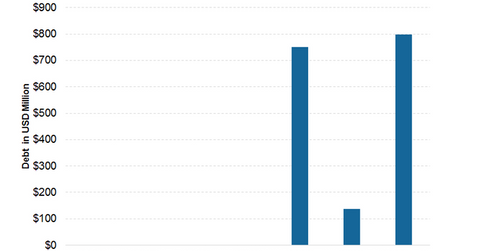

On July 31, 2017, Cliffs Natural Resources (CLF) announced a tender offer for a $575.0 million aggregate principal amount of its 5.75% guaranteed notes due in 2025. The company mentioned in its press release that it intends to use the proceeds from this offering, along with cash on hand, if required, to redeem its outstanding 8.25% senior secured notes due in 2020. This offering is expected to close on August 7, 2017.

Debt management program

This debt offering is in line with CLF’s debt management program. We should note that Cliffs previously made debt offerings to buy its bonds at a discounted price and push its debt maturities further into the future. Cliffs has been quite successful in its previous attempts to achieve these objectives.

Through its latest initiative, the company is probably trying to pay off its near-term maturities (2020–2021) through maturities that are further away; in this case, 2025. The bonds due in 2020 are high-cost bonds. Now seems like an opportune time since the company needs money to fund the capital expenditure for its newly announced HBI (hot briquetted iron) plant in Toledo, Ohio.

Due to improved US steel market conditions in 2016 and 2017 compared to previous years, US steelmakers (SLX) such as U.S. Steel (X), AK Steel (AKS), and ArcelorMittal (MT) have improved their financial conditions considerably.

In the next part of this series, we’ll see how US steel imports and the industry outlook are affecting Cliffs Natural Resources.