Analyzing Chesapeake’s 2Q17 Revenue and Earnings

On August 3, 2017, Chesapeake Energy (CHK) reported its 2Q17 earnings. The company reported revenue of ~$2.3 billion—in line with analysts’ estimates.

Aug. 8 2017, Published 10:10 a.m. ET

Chesapeake’s 2Q17 revenue

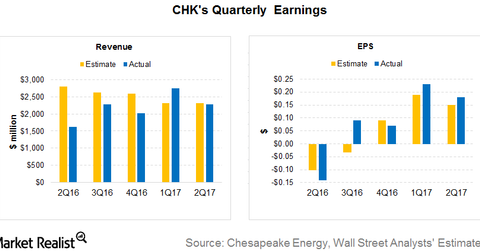

On August 3, 2017, Chesapeake Energy (CHK) reported its 2Q17 earnings. The company reported revenue of ~$2.3 billion—in line with analysts’ estimates.

Chesapeake Energy’s revenue in 2Q16 was $1.6 billion, while it was $2.7 billion in 1Q17.

Chesapeake’s 2Q17 earnings

Chesapeake Energy’s net adjusted income in 2Q17 was $146 million. In 2Q16, Chesapeake Energy reported an adjusted net loss of $115 million.

The company’s adjusted EPS (earnings per share) in 2Q17 was $0.18—compared to Wall Street analysts’ consensus EPS estimate of $0.15. Chesapeake Energy’s adjusted EPS in 2Q16 was -$0.14.

As the above chart on the right shows, Chesapeake Energy’s 2Q17 earnings were better analysts’ expectations.

2Q17 key operational highlights

Chesapeake Energy’s (CHK) production in 2Q17 was 527.6 Mboepd (thousand barrels of oil equivalent per day). In 2Q16, Chesapeake Energy reported production of 657 Mboepd. The company’s production was flat compared to the previous quarter.

Chesapeake Energy noted that it would be falling to 14 rigs by the end of 2017 from 18 rigs currently.

In its 2Q17 press release, Chesapeake Energy’s management said, “Our planned activity levels result in a reduction of our rig count and wells placed on production during the last six months of the year, as our 2017 capital program has been focused on restoring our cash flow generating capability, improving our margins and growing value.”

Asset sales update

So far this year, Chesapeake Energy has sold or agreed to sell its assets worth ~$360 million to various private buyers. As of June 30, 2017, Chesapeake Energy closed $95 million in asset sales, while ~$265 million remains in pending. The asset sales are expected to close by the end of 3Q17.