Analysts’ Recommendations for Toyota in August 2017

Toyota Toyota (TM) is the second-largest auto manufacturer in the world after Volkswagen (VLKAY), according to 2016 global auto sales data. In 2008, Toyota became the world’s largest automaker by volume, despite being founded much later than legacy US auto giants (IYK) General Motors (GM) and Ford Motor (F). Recommendations on Toyota According to recent data […]

Sept. 1 2017, Updated 12:40 p.m. ET

Toyota

Toyota (TM) is the second-largest auto manufacturer in the world after Volkswagen (VLKAY), according to 2016 global auto sales data. In 2008, Toyota became the world’s largest automaker by volume, despite being founded much later than legacy US auto giants (IYK) General Motors (GM) and Ford Motor (F).

Recommendations on Toyota

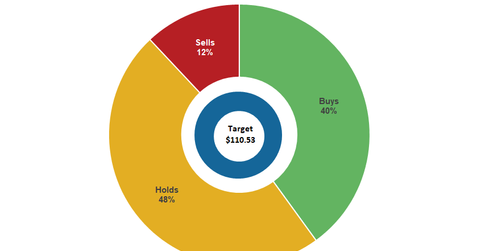

According to recent data compiled by Reuters, about 40% of analysts covering Toyota recommended “buy.” Meanwhile, 48% of analysts were cautious and suggested “hold,” and the remaining 12% gave “sell” recommendations.

As of August 28, 2017, the 12-month consensus target price for Toyota’s ADRs (American depositary receipts) was $110.53, reflecting no upside potential from its market price of $112.27 on the NYSE (New York Stock Exchange). In the last month, analysts’ consensus target price for Toyota has risen from ~$108.15 to $110.53.

Recent developments

In July 2017, Toyota was the only automaker to report a year-over-year increase in its US sales. The company’s US sales rose in July, by 3.6%, unlike sales of peers GM, Ford Motor, and Fiat Chrysler (FCAU).

In contrast, TM’s fiscal 1Q18 (April 1 to June 30, 2017) results were disappointing. Despite a 7% increase in global revenue, its shrinking profit margins raised investors’ concerns about its future growth. The appreciating Japanese yen provided headwinds to Toyota’s profit margins in 1Q18.

The company expects these currency headwinds to continue in the current fiscal year, which could hurt its profitability. This dismal outlook could be why analysts’ consensus price target for Toyota’s ADRs doesn’t show any upside potential. Continue to the next part, where we’ll see what analysts are recommending for Japanese auto giant Honda Motor (HMC).