Analysis of AT&T’s International Business

Regulators are reviewing AT&T’s proposal to merge with Time Warner in a transaction valued at $85.4 billion.

Aug. 16 2017, Updated 10:36 a.m. ET

AT&T’s management decisions

AT&T (T) announced that Lori Lee, CEO of AT&T International and its global marketing officer, will continue to head its international operations after it completes the acquisition of Time Warner (TWX). Regulators are reviewing AT&T’s proposal to merge with Time Warner in a transaction valued at $85.4 billion. The deal could close before the end of this year if approved by regulators.

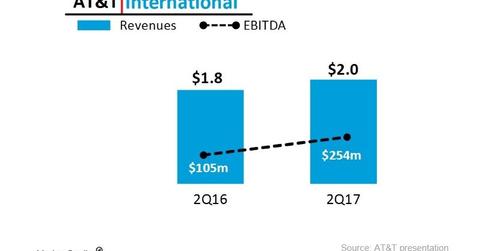

As shown in the chart below, AT&T International continued its robust growth in 2Q17.

International business posts growth

AT&T International’s revenues rose 10.8% to slightly more than $2.0 billion, driven by favorable operating trends in Mexico and Latin America. In contrast, AT&T’s overall revenues fell 2.8% to $39.4 billion.

AT&T reported 476,000 wireless net additions in Mexico in 2Q17, which saw its total subscriber base in the country increase to 13.1 million. More than 5.0 million of those Mexican wireless subscribers are postpaid customers.

AT&T International posted EBITDA[1. earnings before interest, tax, depreciation, and amortization] of $254 million in 2Q17, up from $105 million in 2Q16, as shown in the chart above.

AT&T looking for growth abroad

As competition has intensified in the US (SPY) wireless industry, AT&T has sought to expand abroad where it sees significant growth potential. AT&T’s international push has been characterized by strategic acquisitions in Mexico and Latin America.

As the largest players in the US wireless industry, AT&T and Verizon are facing disruptions from their smaller rivals T-Mobile (TMUS) and Sprint (S), which are using aggressive pricing strategies to undercut them.