Where Vornado Stands among Its Peers

Vornado Realty Trust (VNO) currently offers a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

July 10 2017, Updated 10:35 a.m. ET

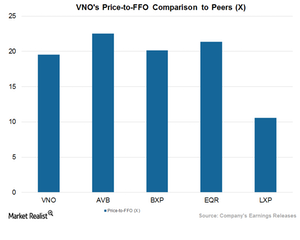

Price-to-FFO multiple

The price-to-FFO (funds from operations) multiple is considered by analysts and investors to be the most effective multiple for evaluating REITs (real estate investment trusts). Because REITs source most of their funds through debt capital, a REIT’s price-to-FFO multiple carries the same implication as the PE (price-to-earnings) ratio to measure relative value for companies in other industries.

Peer group price-to-FFO multiple

Vornado Realty Trust’s (VNO) current price-to-FFO multiple is ~19.5x. The higher price-to-FFO multiple for Vornado reflects the fact that the company was able to return consistent capital value as well as steady dividend yields to its shareholders.

Vornado Realty Trust has undertaken several strategical initiatives like development, redevelopment, and acquisitions and strategic partnerships to boost its presence in high-demand geographies. These strategic initiatives may have spiked its price-to-FFO multiple recently.

In terms of the price-to-FFO multiple, Vornado trades on par with most of its peers except Lexington Realty Trust (LXP), which trades at a much lower price-to-FFO multiple of ~10.6x. Its peers AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR) carry price-to-FFO multiples of 22.5x, ~20.2x, and ~21.4x, respectively.

Peer group dividend yields

Vornado Realty Trust (VNO) currently offers a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors. AvalonBay Communities, Boston Properties, Equity Residential, and Lexington Realty Trust offer NTM dividend yields of 2.9%, 2.4%, 3.0%, and 6.9%, respectively.

Net asset value is another method of assessing REITs’ valuations. Vornado Realty Trust, Boston Properties, and Equity Residential constitute ~12.4% of the iShares Cohen & Steers REIT ETF (ICF). The net asset value of ICF stands at $101.14.

In the final article in this series, we’ll see how analysts view Vornado Realty Trust.