What’s Really Driving Public Storage’s Expected 2Q17 Upbeat Results

Wall Street expects PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

July 25 2017, Updated 7:38 a.m. ET

2Q17 expected to be decent

Public Storage (PSA) is scheduled to report its 2Q17 earnings on July 27, 2017. Wall Street expects the company to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

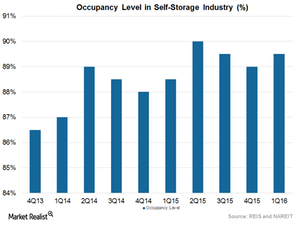

This lower bottom line expectation may be due to higher expenses incurred, which have offset the positive effect of rent growth and higher occupancy.

PSA has maintained its business momentum through regular development and redevelopment, however. This strategy has helped it maintain its efficiency and reap the benefits of economies of scale.

PSA undertook several sales-boosting initiatives in 1Q17, all of which are expected to add to revenues in 2Q17.

Expansion in 1Q17

In 1Q17 (ended March 31, 2017), PSA closed a project of development and redevelopment worth $88.9 million. This included 475,000 square feet of net rentable space.

PSA also has projects worth $618.2 million in the pipeline, which should add 5.2 million square feet of rentable space and new self-storage spaces.

Public Storage has announced a plans to invest $429.9 million in ongoing projects.

Quality matters

PSA builds impressive and enduring storage facilities aimed at giving an impression of security to tenants. The well-constructed buildings built with quality materials have generated more demand.

PSA’s peers include Life Storage (LSI), Macerich (MAC), and Extra Space Storage (EXR). Public Storage and Extra Space together make up 9% of the iShares Cohen & Steers REIT ETF (ICF).