What Wall Street Analysts Recommend for JetBlue Airways

As of September 19, 2017, one analyst out of the 15 analysts tracking JetBlue Airways (JBLU) had a “strong buy” recommendation on the stock.

Sept. 21 2017, Updated 9:08 a.m. ET

Analyst ratings

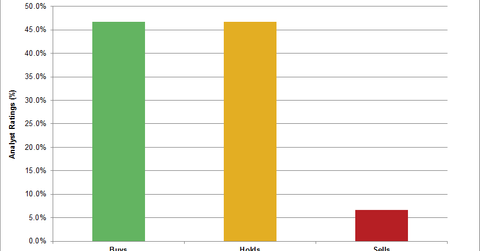

As of September 19, 2017, one analyst out of the 15 analysts tracking JetBlue Airways (JBLU) had a “strong buy” recommendation on the stock. Six analysts had a “buy” recommendation, while seven analysts had a “hold” rating on the stock. None of the analysts had a “sell” rating on the stock, and the remaining one analyst had a “strong sell” rating on the stock.

Analyst upgrades

Only one analyst has upgraded their rating for JetBlue Airways after the guidance update. JPMorgan increased its target price from $26 to $29.

However, there were a few downgrades prior to JetBlue’s guidance update, primarily due to the negativity surrounding airlines after peers Delta Air Lines (DAL), United Continental (UAL), and Southwest Airlines (LUV) reduced their third quarter guidance.

Barclays reduced its target price from $33 to $29. Cowen and Company cut the target price from $25 to $21. UBS reduced its target price from $25 to $23.

Target price

JetBlue has a 12-month consensus target price of $24.6, which is lower than the $26.2 target price the stock had after its 2Q17 earnings report. The highest target price is $31, and the lowest target price is $19. At the current target price, the stock has a return potential of 28.5% from September 19’s closing price of $19.2.

Investors can gain exposure to JBLU by investing in the First Trust Value Line 100 Exchange-Traded Fund (FVL), which holds 0.9% of its portfolio in JBLU.