The Fed’s Interest Rate Hike—A Challenge for Vornado Realty Trust

After increasing interest rates in December 2016, the Fed hiked rates in March and June 2017 by 0.25%.

July 7 2017, Updated 9:07 a.m. ET

Interest rates continue to rise

The Federal Reserve is set to increase interest rates in a phased manner although the country is experiencing below-target inflation growth. According to speculators, the Fed would not be deterred from hiking its rates, although the country reports an inflation rate of 1.4%, which is well below the targeted inflation rate of 2.0%.

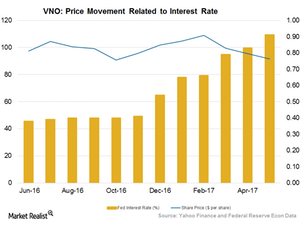

The US witnessed a long period of record low interest rates, after which the Fed finally decided to embark on an interest rate hike policy in 2016. After increasing interest rates in December 2016, the Fed hiked rates in March and June 2017 by 0.25%.

What’s in store for REITs in a hawkish interest rate regime?

REITs like Vornado Realty Trust (VNO), Equity Residential (EQR), Boston Properties (BXP), and AvalonBay Communities (AVB) have until now benefited tremendously from the low-interest rate regime that existed before Fed embarked on its interest rate hike policy. During this phase, REITs have also generated skyrocketing returns due to an environment that was conducive for growth.

However, these REITs reported a downturn of their returns after the Fed announced its intention to hike interest rates in the second half of fiscal 2016.

Vornado, Boston Properties, and Equity Residential comprise ~12.4% of the iShares Cohen & Steers REIT ETF (ICF). ICF’s portfolio is broadly diversified in terms of geography. It can provide a cushion against industrial and macroeconomic headwinds and volatility.

High interest rates reduce affordability of borrowers

In a high-interest rate regime, lenders to REITs are under the burden of higher rates on bank loans, mortgages, and credit cards. This can make the operating environment unfavorable for REITs.

Higher cost of capital for REITs

The cost of capital for REITs can increase when interest rates rise. This trend occurs because REITs mostly fund their operations through debt capital. The high cost of debt affects their margins negatively, as these companies reap profits from the difference between operating costs and interest income.

In a higher interest rate environment, less-risky bonds become preferable to investors as they yield the same returns as those of REITs.

However, it’s not all bad for REITs during a rising interest rate environment. The central bank of a country raises interest rates when the economy shows signs of growth. In a high-interest rate regime, REITs can reap the benefits that come with an economic boon.

In the next article, we’ll see how REITs can benefit from a rising interest rate environment.