How Boeing Stock Has Fared in 2018

Boeing (BA) stock started 2018 on a positive note and carried this momentum forward up to November 7, with a return of ~26%.

Dec. 31 2018, Updated 10:30 a.m. ET

Year-to-date performance

Boeing (BA) stock started 2018 on a positive note and carried this momentum forward up to November 7, with a return of ~26%. However, the stock began plunging on November 8 after investigators of the Lion Air Flight 610 crash pointed out that Boeing had failed to communicate with pilots about a new safety feature on the plane. Lion Air Flight 610 was one of Boeing’s latest and most advanced 737 Max 8 planes. The plane crashed on October 29, killing all 189 passengers and crew members on board.

However, in late November, the stock recovered significantly as analysts observed that the effects of the Lion Air tragedy on the company had been overblown. Boeing was also able to regain investors’ confidence after the Wall Street Journal reported on November 28 that investigators were now looking into the possibility of maintenance issues related to the Lion Air crash. Later, back-to-back reports of Boeing receiving orders for its 737 Max jets from Jeju Air and Caribbean Airlines instilled further confidence in the stock.

Nonetheless, since the start of December, the stock has been on a downtrend once again due to the broader market sell-off. Ongoing trade war uncertainties, weak Chinese economic data, global slowdown worries, and the Fed’s interest rate hike led to the broader market sell-off in December.

Since November 8, the stock has lost ~21% of its value. Moreover, Boeing’s YTD (year-to-date) return entered negative territory for the first time this year on December 24. The company’s shares have declined 0.3% YTD.

Stellar 2017 performance

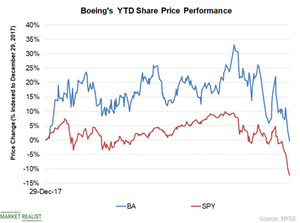

Boeing was among the top-performing Dow Jones 30 index stocks throughout most of 2017. With a return of 88% in 2017, the stock outperformed the gains of the SPDR S&P 500 ETF (SPY), which rose 19.3%.

Boeing’s peers’ performances paled in comparison. Last year, Raytheon (RTN), Northrop Grumman (NOC), Lockheed Martin (LMT), United Technologies (UTX), and General Dynamics (GD) returned ~28.3%, 30.0%, 25.8%, 15.6%, and 14.3%, respectively.