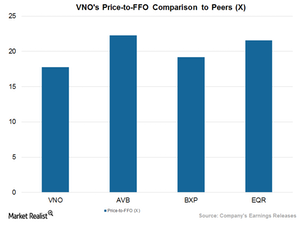

How Vornado Stacks Up against Other Industry Players

VNO’s current price-to-FFO multiple is 17.77x. The company has been able to return value to its shareholders consistently in the form of dividends and share repurchases.

July 27 2017, Updated 7:37 a.m. ET

Price-to-FFO multiple

Residential REITs (real estate investment trusts) like Vornado Realty Trust (VNO) are best evaluated by the price-to-FFO multiple. The multiple is calculated as the ratio between the price and the FFO (funds from operation) of the company and carries the same significance that the PE (price-to-earnings) multiple has in other industries.

Peer group comparison

VNO’s current price-to-FFO multiple is 17.77x. The company has been able to return value to its shareholders consistently in the form of dividends and share repurchases.

Plus, the company’s sales-boosting initiatives and strategic disposition of assets have helped the company concentrate its properties in the high-demand city of New York.

In terms of price-to-FFO multiple, VNO trades on par with most of its peers like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR), which trade at price-to-FFO multiples of 22.5x, 19.18x and 21.57x, respectively.

Peer group dividend yield

Vornado offers a next-12-month (or NTM) dividend yield of 3.6%, in line with close competitors like AvalonBay Communities (AVB), Boston Properties (BXP), and Equity Residential (EQR), which offer dividend yields of 3%, 2.5%, and 3.5%, respectively.

Vornado and its above peers make up 12.4% of the iShares Cohen & Steers REIT ETF (ICF).