How High Interest Could Affect ESS and Residential REITs

REITs such as Essex Property Trust (ESS) yielded high returns in the long period during which interest rates were below average.

July 10 2017, Updated 10:36 a.m. ET

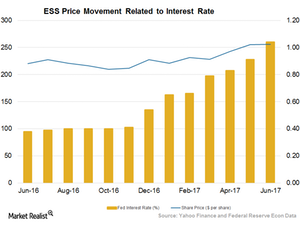

Interest rates continue to rise

The Federal Reserve has already raised interest rates three times in the last six months. The central bank is expected to continue increasing the rate in a phased manner until it reaches its target level.

The United States is now experiencing an inflation rate that’s well below its target rate of 2%. However, the Fed has announced its intention of hiking the rate further.

After a long period of record low inflation, the Fed decided to embark on an interest rate hike policy in 2016. Following the hike, the Fed raised interest rates twice, in March and June 2017, by 0.25% each time.

How REITs fare in a high-interest scenario

REITs (real estate investment trust) such as Essex Property Trust (ESS), AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR) yielded high returns in the long period during which interest rates were below average. This period offered an environment that was conducive to growth for these REITs. However, their returns began to fall after the Fed announced its intention to hike rates in 2H16.

The iShares Residential Real Estate Capped ETF (REZ) has a market cap–weighted index that has a wide product portfolio covering industries such as healthcare, self-storage, and residential REITs. Investors looking for risk-averse investments may want to look to REZ.

Higher interest rates reduce affordability of borrowers

REITs fund their working capital in the form of debt funding. However, in a high-interest-rate environment, lenders to REITs bear the brunt of higher rates on bank loans, mortgages, and credit cards, making funding difficult for REITs.

Higher cost of capital for REITs

The cost of capital for REITs rises in high-interest-rate scenarios. This trend occurs because REITs mostly fund their operations through debt capital. REITs then suffer due to pressurized margins as the high cost of debt decreases the difference between operating costs and interest income.

Less-risky bonds also become more lucrative to investors in high-interest-rate environments because bonds yield the same returns as REITs.

A high interest rate is generally accompanied by a growing economy. A country’s central bank tends to raise its interest rates when the economy is showing signs of growth. REITs don’t have much of an opportunity to harvest the benefits that come with a rate hike and an economic boon.

In the next article, we’ll see how the growing economy could help REITs.