Essex Property: An Apartment REIT Standing Strong amid Headwinds

The current economic environment has made investors skeptical about the real estate investment trust (or REIT) industry.

July 7 2017, Published 2:32 p.m. ET

Recent scenario in residential REITs

The current economic environment has made investors skeptical about the real estate investment trust (or REIT) industry.

The consensus opinion is that the Federal Reserve’s interest rate hike and the dire state of US malls are detrimental for the US REIT industry, and this has made investors jittery about putting their money into the sector.

However, a prudent investor would be wise to look into the matter a little more deeply, as not all REIT stocks are caught in the vortex of the turmoil in the industry. For example, residential REITs such as Essex Property Trust (ESS) don’t have exposure to the retail sector.

The company’s presence in residential and office properties is favorable for it in the present economic scenario, where there’s steady growth in the job market coupled with stable rent growth. Moreover, Essex Property’s strategy of concentrating its properties in Class A high-demand cities is expected to help it maintain a steady share in the market in the future.

In 2016, Essex Property completed its acquisition of 753 apartment homes for $333.7 million. A company with such potential warrants a deeper analysis.

In this series, we’ll look into Essex Property’s growth outlook, the effects of higher interest rates and government policies on its stock, its balance sheet leverage capability, its shareholder rewards, and its valuations.

Bright prospects ahead

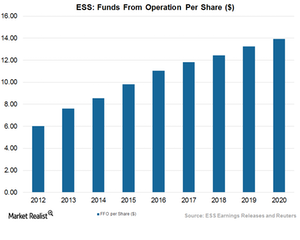

Essex Property is expected to ride high in its growth trajectory. In 2017, Essex expects to report elevated funds from operation (or FFO) in the range of $11.56–$11.96. The company previously expected its FFO to be in the range of $11.46–$11.86. This raised guidance reflects efficiency from operations and higher revenue growth. Analysts expect Essex to report FFO of $11.81, higher than the company’s own expectations.

Analysts also expect the company to maintain its business momentum. Its adjusted FFO are expected to rise 6.4% in 2Q17. Further, the company is expected to post FFO rises of 5.7%, 6.2%, and 4.8% in 3Q17, 4Q17, and 1Q18, respectively.

Strong business momentum

Backed by higher operating efficiency and strategic initiatives of disposition and acquisitions, the company has been able to maintain its business momentum for the past few years. Essex reported adjusted FFO rises of 26.2%, 12.4%, 15%, and 12.4%, respectively, in 2013, 2014, 2015, and 2016. Essex has also been able to beat analysts’ estimates in the past few years backed by its strategic initiatives to boost occupancy.

Strong start to 2017

In 1Q17, Essex reported adjusted funds from operation (or AFFO) per share of $2.94, 1.8% above analyst’s expectations. Its results also came in 9.7% higher than its AFFO of $2.68 in 1Q16. This year-over-year improvement was backed by a boom in housing and construction and an improvement in the job market that drove demand for residential and office facilities.

For 2016, Essex Property reported FFO of $11.04 per share. Its close competitors AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR) reported AFFOs of $8.19, $3.09, and $1.79, respectively.

The iShares Residential Real Estate Capped ETF (REZ), which holds a combined ~20% in AvalonBay, Equity Residential, and Essex Property, witnessed a fall in traded volumes during May 2017 compared to the previous month. This fall was probably due to the macroeconomic uncertainty prevailing in the economy that could be affecting residential REITs negatively.

In the next article, we’ll have a look at Essex Property’s top line performance.