Dividend Growth of Seagate Technology and Garmin

Garmin (GRMN) recorded three-year annualized growth of 5.3%, and its five-year annualized growth fell ~1%. Its growth dipped ~24% in 2016.

July 7 2017, Updated 1:36 p.m. ET

Dividend growth of Seagate Technology

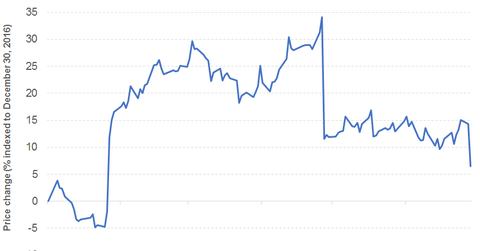

In this final part of the series, we’ll look at the dividend growth trajectory of Seagate Technology and Garmin. Seagate Technology (STX) recorded five-year and three-year annualized growth of ~29% and ~17%, respectively. However, its annual growth recorded a decline of 16% in 2016.

The company has consistently increased its dividend in the last six years. Seagate had a payout ratio of 225% in 2016 and 103.7% on a trailing-12-month (or TTM) basis.

Seagate’s year-to-date stock price has risen 6.5%, and its stock price fell 6.8% on June 27. Seagate remains vulnerable to challenges imposed by the rising popularity of cloud storage. Its partnership with Micron (MU) is expected to cement its presence among rivals such as Western Digital (WDC).

Garmin

Garmin (GRMN) has recorded YoY (year-over-year) growth in its revenues for 1Q17 and 2016. Its EPS rose 1Q17 and 2016 following growth in its operating income. The company’s 2016 results were driven by strong segment performance, with the exception of its Auto segment. Garmin’s 1Q17 results were driven by all segments, with the exception of Fitness and Auto.

Apple’s (AAPL) entry into the wearables market led to a slump in market share for Garmin. Garmin recorded a decline in its YoY free cash flow for 1Q17 after posting impressive growth in 2016. The decline was driven by lower operating cash flow and higher capex.

Garmin’s dividend growth

Garmin (GRMN) recorded three-year annualized growth of 5.3%, and its five-year annualized growth fell ~1%. Its growth dipped ~24% in 2016. Garmin is trading at a discount of 18% to its sector average PE multiple, and it has a dividend yield equivalent to 155% of the sector average dividend yield.

Garmin has recorded growth in its dividend in the last five years. Garmin had a payout ratio of 76.1% and 58.2% for 2016 and on a TTM basis, respectively. Garmin’s year-to-date stock price rose 6.4%, and its stock price fell 1.4% on June 27, 2017.