Discussing Wall Street’s View on Skechers

Skechers (SKX) is covered by 12 Wall Street analysts who jointly rate the company as a 2 on a scale of 1 (“strong buy”) to 5 (“sell”).

July 25 2017, Updated 10:41 a.m. ET

Wall Street’s view on SKX

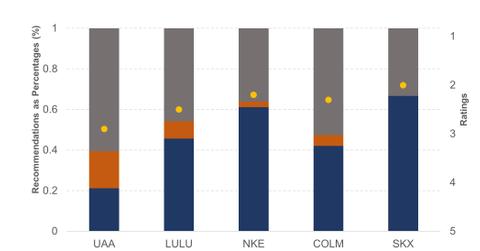

Skechers (SKX) is covered by 12 Wall Street analysts who jointly rate the company as a 2 on a scale of 1 (“strong buy”) to 5 (“sell”). The company has a better rating than other major sportswear players. Lululemon Athletica (LULU), Under Armour (UAA), Columbia Sportswear (COLM), and Nike (NKE) have ratings of 2.5, 2.9, 2.2, and 2.2, respectively.

A total of 67% analysts who cover SKX suggest buying it—more than the 62%, 44%, and 21% of analysts with “buy” ratings on Nike, Lululemon, and Under Armour.

The remaining 33% analysts recommend “holds” on Skechers, while none recommend “sells” on the stock. In comparison, 3%, 8%, and 18% of analysts have suggested selling Nike, Lululemon, and Under Armour, respectively.

Citigroup and Susquehanna are among the brokers who recommend buying SKX, while Standpoint Research recommends holding it. There have been no ratings changes on the company following its 2Q17 results.

Target price

Skechers is currently trading at $28.50, ~15% below it 52-week high. The stock didn’t register any significant price change following its 2Q17 results. Wall Street expects Skechers’s stock price to rise 11% to $31.45 over the next 12 months. Individual target prices for the company range between $25.00 and $35.00.

SKX has a better upside compared to most of its sportswear peers. Nike, Lululemon, and Under Armour are expected to report share price rises of 5%, 0%, and 4%, respectively, over the next 12 months.

ETF investors seeking to add exposure to SKX can consider the First Trust Consumer Discretionary AlphaDEX ETF (FXD), which invests ~0.9% of its portfolio in the company.