CLF and Peers in Overbought Territory: What Triggered It?

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively.

July 20 2017, Updated 7:36 a.m. ET

Technical indicators

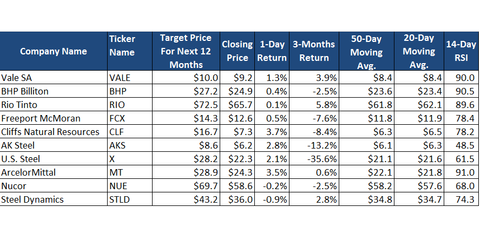

Following our look at Cliffs Natural Resources’ (CLF) analyst estimates, let’s discuss the technical indicators for the company and its peers.

In this part, we’ll look at the moving averages and the relative strength index (or RSI). An RSI above 70 suggests that a stock has been overbought, and a level below 30 indicates that a stock has been oversold.

Is Cliffs Natural Resources overbought?

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively. As you can see in the chart above, this level represents the highest incremental trading over its moving averages compared to its peers. CLF is also trading with a 14-day RSI level of 78.2, which represents an overbought position for the stock.

The recent momentum in the stock prices of Cliffs Natural Resources and its peers resulted from the expectation of a positive outcome of the Section 232 investigation and the resulting import restriction. In the last 15 trading days, CLF’s stock price has risen 23%, resulting in the stock crossing the threshold of an overbought position.

Investors should note that the overbought situation doesn’t automatically mean that these stock prices will revert lower. Stocks can remain oversold or overbought for long periods.

Technicals of CLF’s peers

The stock prices of Cliffs Natural Resources’ peers (XME) in the US steel sector have also appreciated in the last few weeks. ArcelorMittal (MT) and U.S. Steel Corporation (X) are trading 9.7% and 6.0% above their respective 50-day moving averages.

ArcelorMittal and Steel Dynamics (STLD) are trading significantly above the 14-day RSI of 70.0 at 91.0 and 74.3, respectively.

As the chart above shows, Cliffs Natural Resources’ seaborne iron ore peers (PICK) are also trading above the overbought position according to the 14-day RSI. Vale SA (VALE), BHP Billiton (BHP), and Rio Tinto (RIO) have RSIs of 90.0, 90.5, and 89.6, respectively.

While a strong catalyst for seaborne players could represent a further and sustained uptick in iron ore prices, the most potent catalyst for Cliffs Natural Resources and its US-based peers lies in the outcome of the Section 232 investigation.