Can CLF’s Realized Prices See an Uptick in the US Segment?

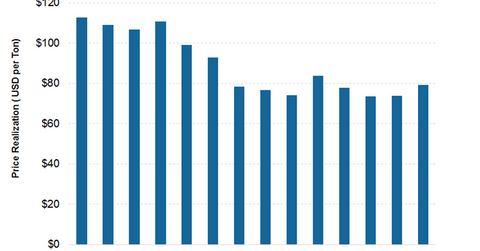

Compared to 1Q16, Cliffs Natural Resources’ average realized prices fell 5% year-over-year to $79.30 per ton in 1Q17.

July 17 2017, Updated 10:42 a.m. ET

Realized revenues from USIO

Along with volumes, realized revenues can determine revenues for miners and can help assess market sentiment. Realized revenues for Cliffs Natural Resources’ (CLF) USIO (US Iron Ore) segment depend on customer demand for iron ore pellets. That demand, in turn, depends on existing and expected steel prices in the domestic market.

US steel prices

US steel prices (SLX) are holding steady in anticipation of the results of the Section 232 probe into steel imports in the US. Cliffs Natural Resources’ CEO, Lourenco Goncalves, is hopeful that the outcome of this probe could result in the imposition of tariff quotas.

Cowen and Company hosted Cliffs Natural Resources’ management and investors to discuss Section 232 and CLF’s newly announced HBI (hot briquetted iron) plant. During this event, Goncalves noted that this probe could cause steel imports to decline significantly.

Under such a scenario, US HRC (hot rolled coil) prices could rise to $800 per ton. Higher spot prices could boost the earnings of steelmakers like U.S. Steel Corporation (X), Nucor (NUE), and ArcelorMittal (MT).

Upside to realized revenues

Compared to 1Q16, Cliffs Natural Resources’ average realized prices fell 5% year-over-year (or YoY) to $79.30 per ton in 1Q17. The company’s management was expecting this decline due to the carryover pricing impact from 2015 and 2016 and a change in customer mix.

During its 1Q17 earnings call, Goncalves noted that since all of its carryover tons were worked off, the company expects a substantial lift in realized prices for the remainder of 2017. During its 1Q17 results, Cliffs Natural Resources reduced its EBITDA[1. earnings before interest, tax, depreciation, and amortization] guidance from $850 million to $700 million for 2017. This reduction was in line with the decline in seaborne iron ore prices and US HRC prices.

In the next article, let’s look at Cliffs Natural Resources’ Asia-Pacific division.