Which Stocks Are Uptrending in Their Correlations to Gold?

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals.

Nov. 20 2020, Updated 2:42 p.m. ET

Miners and precious metals

We saw in the previous parts of this series that some geopolitical issues could have impacted precious metals and their mining funds and shares. In this part, we’ll focus on the comparative performances of mining shares and precious metals.

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals and which are not. It’s also possible that some stocks have a high correlation to gold at one point and a low correlation at another.

The ETFS Physical Swiss Gold (SGOL) and the ETFS Physical Silver (SIVR) closely follow gold and silver, respectively. They have risen 10.0% and 7.9%, respectively, year-to-date.

Correlation trends

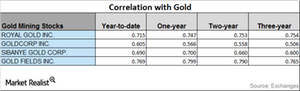

Among Royal Gold (RGLD), Goldcorp (GG), Sibanye Gold (SBGL), and Gold Fields (GFI), Gold Fields has the highest correlation with gold, and Goldcorp has the lowest. Over the past three years, Goldcorp, Gold Fields, and Sibanye Gold have seen rising correlations with gold, whereas Royal Gold has seen its correlation to gold fall.

It’s important to study upward and downward trends because price change predictability can be influenced by the direction precious metals take. Gold Fields, for example, has a three-year correlation with gold of ~0.77 and a one-year correlation of ~0.80. A correlation of ~0.80 suggests that Gold Fields moved in the same direction as gold ~80.0% of the time.

For ongoing updates on this industry, be sure to stay updated with Market Realist’s Metals and Mining page.