What Were Schlumberger’s Drivers in 1Q17?

Schlumberger’s (SLB) Latin America region witnessed the highest revenue decline (30% fall) in 1Q17—compared to 1Q16.

June 1 2017, Updated 4:05 p.m. ET

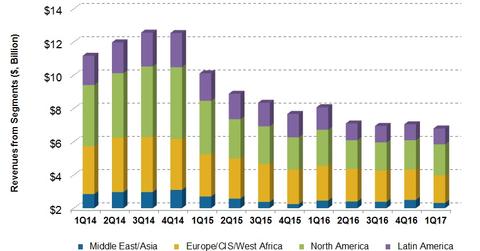

Schlumberger’s 1Q17 revenue by geography

Schlumberger’s (SLB) Latin America region witnessed the highest revenue decline (30% fall) in 1Q17—compared to 1Q16. Its Europe/CIS/West Africa revenue fell ~21%, while its North America revenue fell 14%. Schlumberger’s revenue from the Middle East fell 6% from 1Q16 to 1Q17. Schlumberger accounts for 6.7% of the ProShares Ultra Oil & Gas ETF (DIG).

Segment margin analysis

Schlumberger’s Reservoir Characterization segment’s 1Q17 operating income margin fell to 17% from 19% last year. The Production segment’s operating margin fell to 5% in 1Q17 from 9% in 1Q16. The Drilling segment’s operating margin fell to 12% in 1Q17 from 15% in 1Q16.

Negative drivers

- lower multiclient license sales in the WesternGeco unit

- decline in offshore drilling activity

- seasonal activity decline in the Northern Hemisphere

- reduced project volume and product sales in Cameron Group

- continuing pricing pressure on Schlumberger’s new tender awards

Positive drivers

- accelerated North America onshore drilling activity due to a 25% higher US rig count and higher stage count

- higher pricing due to improved capacity utilization in North America

- stronger OneSubsea activity in Brazil

What impacted Schlumberger’s 1Q17 earnings?

In 1Q17, Schlumberger’s reported net income was ~$279 million—a 44% fall compared to when Schlumberger reported $501 million in net income. However, its 1Q17 earnings improved compared to 4Q16 when Schlumberger recorded net loss of $204 million.

Net loss for Schlumberger’s peers

In comparison, Superior Energy Services’ (SPN) reported net loss was ~$90 million in 1Q17. In 1Q17, Fairmount Santrol Holdings’ (FMSA) net loss was $11.4 million, while Flotek Industries’ (FTK) net loss was ~$1 million.

So, how much does Schlumberger depend on North America? We’ll discuss this in the next part.