US Hotel Industry Supply to Outpace Demand in 2017

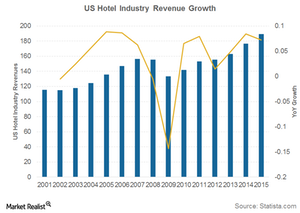

The US hotel industry saw its largest revenue fall of 14% year-over-year (or YoY) in 2009. Since then, recovery has been steep.

July 3 2017, Updated 7:35 a.m. ET

US hotel industry revenue

The US hotel industry saw its largest revenue fall of 14% year-over-year (or YoY) in 2009. Since then, recovery has been steep. For the following five years, from 2010 to 2015, the hotel industry clocked a 6% compound annual growth rate (or CAGR).

In 2015 only, hotel industry revenue rose at a rate of 7% YoY to $189.5 billion. The industry’s 2016 data haven’t yet been reported.

Demand versus supply

Demand growth overtook supply growth in 1Q17. Supply rose 1.9% YoY. However, going forward in 2017, demand is expected to moderate.

In 2017, STR expects demand to rise 1.7% YoY. For the same period, supply is expected to rise at a rate of 2.0% YoY. PricewaterhouseCoopers shares this view. On the other hand, CBRE Hotels continues to expect demand to outpace supply growth. According to CBRE, supply in 2017 is expected to rise 2% YoY, and demand is expected to rise 1.7% YoY.

Series outlook

In this series, we’ll analyze key hotel indicator trends, including hotel occupancy and average daily rates, which are driven by room demand and supply. We’ll also discuss the impact of falling crude oil prices and the strengthening US dollar on the hotel industry. Investors can use these indicators to define their outlooks on the US hotel industry.

Investors can gain exposure to hotel stocks by investing in the Consumer Discretionary SPDR ETF (XLY), which holds 1.2% in Marriott International (MAR), 0.51% in Hilton Worldwide (HLT), and 0.42% in Wyndham Worldwide (WYN). It has no holdings in Hyatt Hotels (H).