Understanding Prologis’s Multiples Next to Those of Peers

Prologis’s price-to-FFO multiple is now 20.95x, which means that it has been returning consistent capital value and reliable dividend yields to investors.

June 22 2017, Updated 7:35 a.m. ET

Price-to-FFO multiple

The most popular method of assessing the relative value of an REIT (real estate investment trust) like Prologis (PLD) is by using its price-to-FFO (funds from operations) multiple. The price-to-FFO multiple for REITs holds the same significance that the PE (price-to-earnings) ratio holds for companies operating in other industries. NAV (net asset value) is also a method of valuation for REITs.

Peer group price-to-FFO multiple

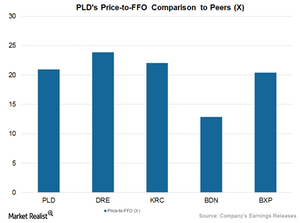

Prologis’s (PLD) current price-to-FFO multiple is 20.95x, which means that PLD has been returning consistent capital value and reliable dividend yields to investors. The company has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies. These strategic initiatives, along with its enhanced guidance for 2017, must have led to the recent rally in PLD’s share price, which caused a spike in the company’s price-to-FFO multiple.

By comparison, Brandywine Realty Trust (BDN) is trading at a lower price-to-FFO multiple of 12.9x, while Duke Realty (DRE), Kilroy Realty (KRC), and Boston Properties (BXP) have price-to-FFO multiples of 23.9x, 22.1x, and 19.1x, respectively.

Peer group dividend yield

Prologis currently offers a next-12-month dividend yield of 3.1%, which is in line with those of its close competitors. Duke Realty (DRE) offers a dividend yield of 2.7%, while Kilroy Realty offers a dividend yield of 2.2%, and Brandywine Realty Trust (BDN) offers a dividend yield of 3.6%.

Notably, Prologis, Duke Realty, Kilroy, and Boston Properties together make up 14.1% of the iShares Cohen & Steers REIT ETF (ICF). ICF’s NAV currently stands at $102.1.

In the next and final part of this series, we’ll see how the analysts are viewing Prologis.