Baxter’s Global Business Units Continue to Deliver

Baxter International’s (BAX) global business units delivered strong performances in the second quarter.

Aug. 17 2018, Updated 11:46 a.m. ET

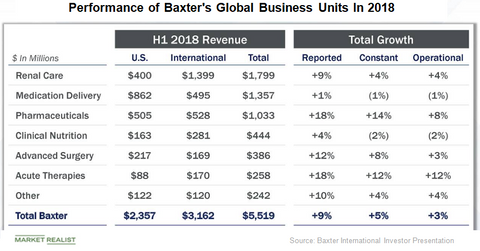

Global business unit performance

Baxter International’s (BAX) global business units delivered strong performances in the second quarter.

Renal care sales, including peritoneal dialysis, hemodialysis, and additional dialysis therapies and services, increased from $854 million in the second quarter of 2017 to $931 million in the second quarter of 2018. This increase was due to global growth in the peritoneal dialysis business and higher international hemodialysis sales.

Medication delivery sales, including intravenous therapies, infusion pumps, administration sets, and drug reconstitution devices, decreased marginally from $683 million in the second quarter of 2017 to $681 million in the second quarter of 2018. The decrease was the result of lower growth in Baxter’s large volume parenterals in the United States and supply constraints in the small volume parenterals resulting from Hurricane Maria.

Pharmaceuticals and clinical nutrition units

Sales from the pharmaceuticals business, including premixed and oncology drug platforms, inhaled anesthesia, and critical care products, increased from $450 million in the second quarter of 2017 to $537 million in the second quarter of 2018 due to strong growth in the US injectables business resulting from higher Brevibloc sales.

For the remainder of 2018, Baxter expects Brevibloc sales to be negatively impacted due to increased competition in the market. Baxter’s 2017 Claris acquisition contributed $33 million to its pharmaceuticals sales during the second quarter.

Clinical nutrition sales, including parenteral nutrition therapies, increased from $216 million in the second quarter of 2017 to $221 million in the second quarter of 2018 due to improved international volumes for nutritional therapies.

We’ll take a look at Baxter International’s operational performance in the next article.