Why China’s June Iron Ore Import Outlook Is Strong

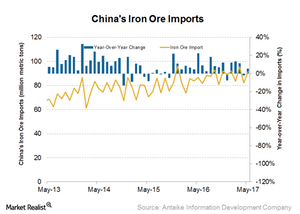

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017.

July 3 2017, Updated 7:37 a.m. ET

Chinese iron ore imports

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017. This is also a gain of 5.5% year-over-year. Weather-related shipment issues in Australia likely impacted imports in April. Steel mills in China continued churning out higher volumes to take advantage of attractive margins in the domestic market. Higher imports are also in line with strong shipment data out of Australia in April.

As we saw previously in this series, shipments from Australia hit a record high in May, which should translate into higher imports in June as well.

Resilient demand

In the first five months of the year, imports have risen 8.0%. As the Chinese government cracks down on polluting steel units, higher-content iron ore with low impurities is on the rise, which supports imports from Australia and Brazil. The cost of ore from these destinations is also very efficient compared to domestic ore, resulting in replacement of domestic ore.

Customs data and China’s iron ore imports

China’s iron ore imports data is important for investors. They provide a cue regarding the demand patterns for imported iron ore among Chinese mills and traders. China is the largest consumer of seaborne iron ore, consuming two-thirds of all seaborne iron ore. Therefore, Chinese demand affects seaborne iron ore players (PICK) such as Cliffs Natural Resources (CLF), Vale (VALE), BHP Billiton (BHP), and Rio Tinto (RIO).