Interesting Options for Summer Investments

Summer is finally here after only nine months of waiting. Now might be a good time to look at investments that have to do with the summer months.

June 30 2017, Published 9:55 a.m. ET

Direxion

Summertime and the Livin’ Is…Directional

Summer is finally here after only nine months of waiting. Now might be a good time to look at investments that have to do with the summer months. Not only will we examine ETFs that relate to summer activities, but we’ll also see whether they tend to make good investments during the summer.

Summer is for road trips, blasting the AC when it gets too hot, getting woken up by the sound of construction on a sunny Saturday, and shopping for a new home when the spring flowers bloom into summer. For our summer road trip, we’ll look at energy consumption via the ERX (Daily Energy Bull 3X) and the ERY (Daily Energy Bear 3X).For our air-conditioned blasts after sitting on a hot beach, we’ll look at GASL (Daily Natural Gas Bull 3X) and GASX (Daily Natural Gas Bear 3X). Homebuilders will wake us up (or not) with their hammering, and we’ll see it in NAIL (Daily Homebuilders and Suppliers 3X Bull) and CLAW (Daily Homebuilders and Suppliers 3X Bear). And finally, shopping for a new home, we’ll look at DRN (Daily MSCI Real Estate Bull 3X) and the DRV (Daily MSCI Real Estate Bear 3X). Let’s hit the research beach.

Market Realist

How have sectors fared in summer?

Historical data have shown that summer hasn’t been so rewarding for the S&P 500 Index (SPY)(SPX-Index). The table below by Direxion Investments shows a summer monthly average return of -0.12% for the S&P 500. However, since the US election, the S&P 500 Index has been doing pretty well, having gained 14% as of June 22. Expectations of rising inflation, improving economic growth, a strong dollar, and fewer regulations resulting from the new administration benefited US equities, driving the S&P 500’s returns.

Whether you hope that the new administration can drive higher returns or not, Direxion has you covered through SPXS (3X Bear S&P 500) and SPXL (3X Bull S&P 500).

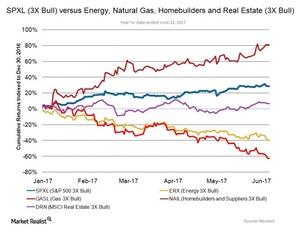

In this series, we’ll focus mainly on four sectors (energy, natural gas, real estate, and homebuilders) and their summer performance. We’ll see how they’ve fared alongside the S&P 500. The chart above shows the year-to-date performance of Direxion 3X Bull ETFs for each sector and the S&P 500 as of June 22.

You can see that the NAIL (Daily Homebuilders and Suppliers 3X Bull) has outperformed the SPXL (3X Bull S&P 500) year-to-date. The GASL (Daily Natural Gas Bull 3X) and the ERX (Daily Energy Bull 3X) have lagged behind while the DRN (Daily MSCI Real Estate Bull 3X) is catching up.

Let’s dig into each of the sectors’ summer performance.