Is a Flattening Yield Curve a Sign of an Impending Recession?

Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

June 22 2017, Updated 9:07 a.m. ET

Yield curve shapes: Normal, flat, and inverted

In normal economic cycles, the shape of a yield curve changes based on the prevailing market conditions. Although the yield curve is usually upward sloping, it can flatten if short-term rates are rising faster than long-term rates.

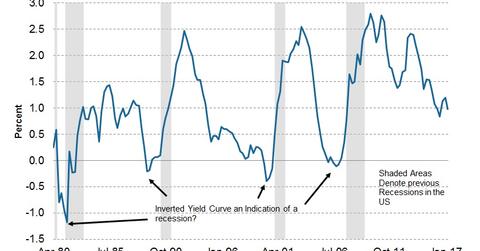

In rare cases, the yield curve can be inverted, which means short-term bonds have a higher yield than long-term yields. Yield curve inversion occurs when investors are expecting an economic slowdown, lower inflation, and possible rate cuts from the Fed.

Current bond market conditions

After the US elections, bond yields have increased in anticipation of increased growth in the US economy, higher inflation, and lower unemployment. The latest FOMC (Federal Open Market Committee) statement indicated that the Fed is committed to hiking interest rates in the near term.

Traders’ views with respect to this outlook can be evaluated by looking at the flattening yield curve. Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

The two-year and ten-year yield spreads have fallen below the 80-basis-point mark as bond markets are pricing in lower inflation premiums for longer maturity bonds.

The yield curve has only flattened, but it’s not inverted

Taking a look at the past, there have been recessions after a yield curve inversion, as indicated in the graph above. Do investors need to worry that the yield curve is flattening?

In our view, it may not be appropriate to worry at this point. Markets are driven by data, and we can observe the incoming inflation and employment data to further assess the bond market’s (BND) conditions.

There is a possibility of lower inflation (SCHP), helped by weakening oil prices. At the same time, the impact can be balanced with rising employment and consumer spending.

It can take many months, or even years, for the yield curve to invert. For now, markets could ride the wave of optimism. We expect investors to remain cautiously optimistic in the near term as they watch the Trump administration’s policies.