How’s the Industry Outlook for Cliffs for the Rest of 2017?

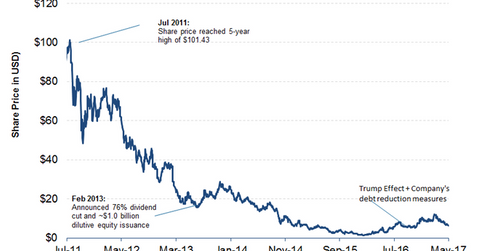

May 2017 was quite a volatile month for Cliffs Natural Resources (CLF) and its peers. Cliffs fell 12.4% in May alone, bringing its year-to-date losses to 30%.

June 2 2017, Published 11:33 a.m. ET

US steel stocks in May

May 2017 was quite a volatile month for Cliffs Natural Resources (CLF) and its peers. Cliffs fell 12.4% in May alone, bringing its year-to-date losses to 30%.

Cliffs’ US steel peers (SLX) also saw losses, but not to the extent seen in CLF stock. U.S. Steel Corporation (X) and ArcelorMittal (MT) fell 6.6% and 6.7%, respectively, in May, while Nucor (NUE) and AK Steel (AKS) fell 5.3% and 3.8%, respectively.

Factors impacting market sentiment

Cliffs has underperformed both its US steel peers and seaborne iron ore players. Cliffs is much more leveraged than its peers. Recently, US steel prices, which drive revenue and earnings for Cliffs’ US division, have fallen. Seaborne iron ore prices have also been on the decline since April. These factors have led to the deterioration of the market sentiment for Cliffs.

Commodity companies have to deal with market forces over which they have no control. Cliffs has done a good job of improving the conditions it’s able to, including debt and cost reduction.

Series overview

In this series, we’ll look at some industry fundamentals that could drive Cliffs’ stock going forward. We’ll analyze the steel demand-supply dynamic and factors such as US steel production, demand, prices, and imports.

As Cliffs stock is also governed by the dynamics in the seaborne iron ore industry, we’ll be sure to look at factors such as the Chinese steel demand outlook, the supply situation, and the price outlook.

We’ll start by looking at US imports in the next article.