How Bond Buybacks Add Value

As of June 30, 11 fallen angel companies had issued tender offers YTD, boosting their bond prices by 5% on average.

Nov. 20 2020, Updated 3:59 p.m. ET

How buybacks add value

Companies typically establish a tender offer price that is a premium to a bond’s current price in order to entice investors to sell. As of June 30, 2016, 11 fallen angel companies had issued tender offers YTD (year-to-date), boosting their bonds’ prices by 5% on average between the day prior to and the day after the tender offer. Mainly, from basic industry and energy sector issuers, five of the 11 firms were fallen angel entrants in 2016, including Ensco, Encana, Noble Holdings, Anglo American Capital, and Southwestern Energy Company.

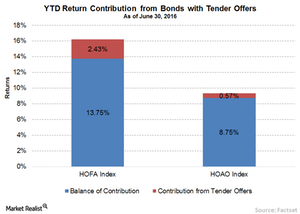

As shown in the graph below, bonds with tender offers contributed more than 243 bps (basis points) to the ~16.2% YTD return of the BofA Merrill Lynch US Fallen Angel High Yield Index (H0FA), as of June 30. By contrast, the BofA Merrill Lynch US High-Yield Index (HOAO) returned ~9.3%, of which just over 57 bps can be attributed to bonds with tender offers in 2016.

Source: FactSet. Data as of June 30, 2016. Past performance is no guarantee of future performance. Contribution is presented for the BofA Merrill Lynch US Fallen Angel High Yield Index (H0FA) versus BofA Merrill Lynch US High Yield Index (H0A0) for the broad high yield bond market. Figures are gross of fees, non-transaction based and therefore estimates only. Please click the “Disclosures” link at the beginning of this article for descriptions of the indices referenced in this chart. Fund performance current to the most recent month end is available by visiting www.vaneck.com/etfs.

A greater proportion of the HOFA Index than the HOAO Index has been impacted by bond buybacks. As of June 30, 10.5% of the HOFA index’s market value was made up of bonds that had issued tender offers YTD (year-to-date), versus the broad high-yield bond market’s 3.3% (HOAO). One major difference for fallen angel investors is that the debt issued to finance buybacks does not qualify for the HOFA index, since new bonds would typically be issued as high-yield bonds. As such, fallen angel investors are not financing the buyback by buying new debt.

Companies recognize the value in buying back bonds for a variety of reasons. For investors, it signals the companies’ willingness and ability to meet their debt obligations. For fallen angels, bond buybacks have served as another source of value so far this year.

At Market Realist, we believe bond buybacks offer another compelling reason for investors to look at the potential of this asset class.

Market Realist: bond buybacks can create substantial value

As discussed in the corresponding part of this series, bond buybacks in various funds (ANGL) can create tremendous value for investors—and, in many cases, to issuers as well. In recent times, as prices have started declining to record lows, bond buybacks begin to happen at a rapid pace. Lower bond prices are appealing to issuers because they give issuers the opportunity to buy back their bonds at a huge discount to face value, thus allowing for an accounting profit.

Bond buybacks are even so beneficial for the issuer that in the first half of the year, many companies offered to buy back their bonds at a premium. Steel giant ArcelorMittal (MT), for example, offered to purchase cash bonds worth $1.5 billion to reduce gross debt through the early repayment of medium-term maturing bonds. Similarly, Genel Energy tendered an offer to buy back a $750-million issue that was trading at about half its face value. Rio Tinto (RIO) is using its strong liquidity position to reduce total debt through the prepayment of some of the bonds maturing in 2017 and 2018.

Meanwhile, Deutsche Bank (DB) and Anglo American (AAL) have both announced multibillion-dollar bond buyback tenders. According to RBS, cash bond buybacks tendered totaled 83.5 billion euros, or about $92.5 billion, YTD in Europe—much higher than during the same period last year.