How AvalonBay Communities Leverages Its Balance Sheet

AvalonBay has been able to maintain a low debt-to-equity ratio in the last five years. The company reported a debt-to-equity ratio of ~1.5x in 1Q17.

June 16 2017, Updated 9:06 a.m. ET

Higher leverage is a prerequisite for expansion

To meet the requirement of paying at least 90% of their taxable income to investors as dividends, REITs like AvalonBay Communities (AVB) depend on external debt. They must opt for higher leverage to increase their real estate holdings. As a result, their interest expenses increase, which could squeeze their margins.

REITs require expansion in real estate holdings to create additional income sources. REIT managers work to maintain an optimal debt structure, which depends on how well the REIT converts its higher leverage to its advantage. AVB’s consolidated debt in 2016 was $7.1 billion—higher than its 2015 debt level of $6.5 billion.

Debt-to-equity ratio

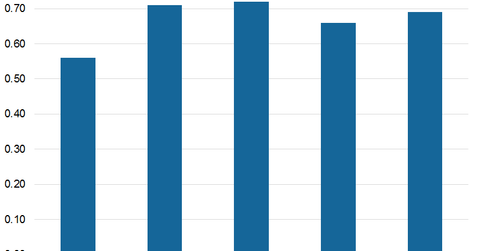

AvalonBay has been able to maintain a low debt-to-equity ratio in the last five years. The company reported a debt-to-equity ratio of ~1.5x in 1Q17. The industry’s median debt-to-equity ratio is ~1.0x. The chart above shows the trend of AVB’s debt-to-equity ratio for the past five years.

Compared to its peers, DDR Corporation (DDR) had the highest debt-to-equity ratio of 1.6x. It was followed by GGP (GGP), which had a debt-to-equity ratio of ~1.5x, and Kimco Realty (KIM), which had a debt-to-equity ratio of 0.98x.

AvalonBay occupies 9% of the iShares Trust – iShares Residential Real Estate Capped ETF (REZ). This ETF has a low beta of 0.98% and a market cap–weighted index that covers diverse industries such as healthcare, self-storage, and residential REITs.

Average interest rates

The weighted average interest rate of AVB’s fixed-rate mortgage notes payable was 4.4% for March 2017. The weighted average interest rate on its variable rate mortgage notes payable was 2.5% and 2.3% for March 2017 and December 2016, respectively. The average interest rate on the company’s total debt was 2.6% in March 2017.

In the next part of this series, we’ll examine AVB’s valuation in comparison to its peers.