How Are the Defensive and Cyclical Sectors Performing?

If we compare the performances of the defensive sectors, we can see that their YTD performance and one-year performances have been reasonably uniform with the exception of the energy and telecom sectors.

June 22 2017, Updated 7:38 a.m. ET

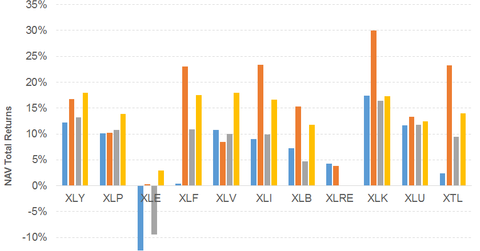

Performance of defensive sectors versus cyclical sectors

If we compare the performances of the defensive sectors, we can see that their YTD performance and one-year performance have been reasonably uniform with the exception of the energy and telecom sectors. Consumer staples, utilities, and health care have recorded the most uniform returns on YTD, one-year, and three-year annualized bases. Energy has recorded the highest decline among the sectors. The production cut agreement between OPEC and non-OPEC countries was aimed at recovering the profitability of the energy sector. The stronger US dollar and Donald Trump’s pro-production approach have the potential to wreak further havoc on the sector.

The cyclical sector rally was mostly in anticipation of Donald Trump’s pro-growth and American-centric policies. The S&P 500 sectors have been on a roll since the 2016 presidential election results. Financials, technology, and industrials have beaten the S&P 500 in the past one year.

Technology, utilities, health care, industrials, and the consumer sectors have beaten the S&P 500 in the last six months. However, on a YTD basis, a huge fraction of the gains have been wiped off, which is evident from the chart above. This is mainly due to the rising uncertainty associated with Donald Trump’s deregulation and tax policies. All the sectors have recorded growth in their price-to-earnings ratios in the past one year with the exception of utilities.

The First Trust STOXX European Select Dividend Index Fund (FDD) and the iShares International Select Dividend ETF (IDV) have generated YTD returns between 13%–14%. The Europe-dominated ETFs have substantial exposure in financials, the latter being more diversified than the former. Both offer an annual dividend yield of more than 4% and are valued between 15x–17x. The SPDR S&P Dividend ETF (SDY), valued at ~20x, recorded a YTD return of 6% and offers an annual dividend yield of 2.4%. The ETF has a balanced exposure across all the sectors. AT&T (T), AbbVie (ABBV), Target (TGT), Caterpillar (CAT), and Chevron (CVX) are important holdings of the ETF.