Can Backwardation Drive Energy Returns?

ETF Securities A return to backwardation? Among the three components of total return when investing in futures contracts (price return, roll yield, and collateral yield), the roll yield for the energy sector has been a continuous performance drag over the last decade (see “Drag on performance” chart below). Oil futures markets are most often in […]

June 21 2017, Updated 7:36 a.m. ET

ETF Securities

A return to backwardation?

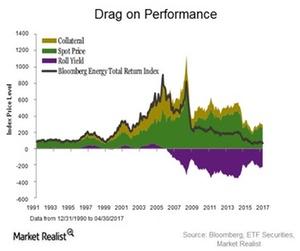

Among the three components of total return when investing in futures contracts (price return, roll yield, and collateral yield), the roll yield for the energy sector has been a continuous performance drag over the last decade (see “Drag on performance” chart below).

Oil futures markets are most often in a state of contango, whereby the futures price is greater than the spot price. When inventors roll into new contracts at expiration, there is an implied cost of buying a more expensive contract, resulting in a negative roll yield component to total return.

Since oil prices bottomed out in early 2016, the degree of contango in futures markets has been reduced. Year to date, the oil market has become even closer to backwardation (see “Contango in oil markets continues to fall” chart below). If global supply is reduced at a higher rate and oil inventories continue to experience drawdowns, this may push the market towards backwardation thereby bringing roll yield back into focus as a key contributor for oil and energy total returns.

Another component of total returns that has diminished over the last decade is collateral yield. In the current low-interest rate, the yield garnered from holding collateral against futures contracts has been minimal. This may see a bit of a reprieve against expectations of further tightening by the Federal Reserve this year. Additionally, nominal interest rates are a key driver for energy commodity prices, and a rising rate environment may be met with higher prices. Crude oil and gasoline perform positively on average in rising rate environments while natural gas tends to benefit from falling market interest rates (see “Rising rates may boost oil and energy prices” chart below).

Market Realist

Contango and Backwardation in oil prices

The crude oil futures market (USO) (USL) is often in contango, which describes the upward sloping shape of the futures forward curve. Contango points to market reaction to lower current demand for crude oil and prevails during periods of weak oil prices. However, it also reflects expectations of higher demand and higher prices in the future.

OPEC’s (Organization of the Petroleum Exporting Countries) recent decision to cut crude oil output, which intended to limit excess oil in the market and boost oil prices, has reduced the scale of contango in the futures market. If the supply-demand balance becomes tight enough and the current demand for crude oil rises, it could lead to backwardation, causing the crude oil futures forward curve to slope downward.

Backwardation could bring back positive roll yield, one of the three sources of commodities futures returns. Roll yield is the yield arising out of the difference between the spot price and future prices of a commodity. In backwardation, roll yield is positive.

Among the three sources of commodities futures returns, the collateral yield is the interest earned on the collateral used to enter into a futures contract. However, this yield has become quite small in the current low-interest rate environment. Empirical data, as shown in the above table, indicate that oil prices react positively in a rising interest rate environment.

In addition, expectations of further Fed rate hikes in 2017 could boost the economy. A strong economy could lead to higher crude oil demand and thus higher oil prices. Rising oil prices can ultimately drive higher returns for the energy sector (XLE) (ERY).

One way to mitigate issues such as backwardation and even short-term interest rate fluctuations would be to find an ETF that shields investors from these concerns. ETF Securities’ Bloomberg Energy Commodity Longer Dated ETF (BEF) is a three-month forward product that reduces roll yield issues while providing ample liquidity.