Inside Align Technology’s Robust Revenue Growth Projection for 2017

For fiscal 2017, Align Technology (ALGN) expects its 2017 revenues to grow operationally in the range of 15%–25% YoY.

June 12 2017, Updated 5:35 p.m. ET

Align’s revenue guidance for 2017

For fiscal 2017, Align Technology (ALGN) expects its 2017 revenues to grow operationally in the range of 15%–25% YoY (year-over-year). However, based on its robust 1Q17 performance, the company is confident that the 2017 YoY revenue growth will be closer to the higher end of the projected range.

Align Technology categorizes sales of its products under two operating segments, Clear Aligner and Scanners. For fiscal 2017, the company has also projected revenue and volume growth for its Invisalign clear aligner systems to be at the midpoint or toward the higher end of the 15%–25% operating model range.

In 2016, the company’s scanner business benefitted from the demand backlog carried forward from 2015. Since the company will not enjoy this benefit in fiscal 2017, Align Technology has projected muted revenue and volume growth for the scanner business on a YoY basis.

Notably, the First Trust Health Care AlphaDEX Fund (FXH) has about 2.7% of its total portfolio holdings in Align.

Robust revenue growth

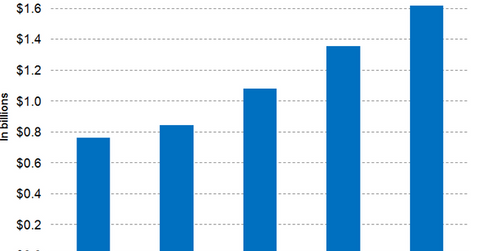

Wall Street analysts have projected Align Technology’s 2017 revenues to be around $1.4 billion, which would be a YoY rise of ~25.4%. For fiscal 2017, peers Dentsply Sirona (XRAY), Danaher (DHR), and 3M Company (MMM) are expected to report revenues close to $4.0 billion, $18.0 billion, and $30.8 billion, respectively.

In line with the guidance provided for fiscal 2017, Align Technology’s Clear Aligner segment reported revenues close to $282.4 million in 1Q17, which is a YoY rise of ~28.5% and a QoQ rise of more than 12.3%. Its Scanner and Services segment, however, reported revenues of close to $27.9 million, which represents a YoY rise of around 46.9% but a QoQ fall of around 33%.

In the next part, we’ll discuss the market opportunities for Align Technology’s product offerings.