What’s National Oilwell Varco’s 7-Day Stock Price Forecast?

NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017.

May 16 2017, Updated 9:07 a.m. ET

Stock price forecast for National Oilwell Varco

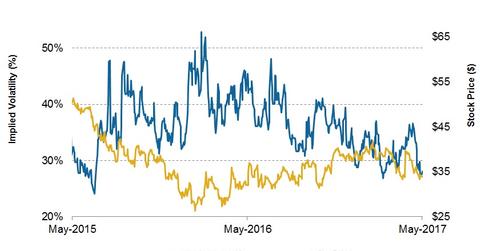

Based on National Oilwell Varco’s (NOV) implied volatility and assuming normal distribution of stock prices and one standard deviation probability of 68.2%, NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017. That day, NOV’s implied volatility was ~28.0%.

Since NOV’s 1Q17 financial results were announced on April 26, 2017, its implied volatility fell from ~33.0% to the current level. NOV makes up 0.07% of the iShares MSCI ACWI Low Carbon Target (CRBN). The energy sector makes up 5.5% of CRBN.

What does implied volatility mean?

IV (implied volatility) reflects investors’ views of a stock’s potential movement. However, IV doesn’t forecast direction. It’s derived from an option pricing model. You should note that the correctness of an implied volatility suggested price can be uncertain.

Implied volatility for NOV’s peers

Carbo Ceramics’ (CRR) volatility on May 11, 2017, was ~69.0%. Helmerich & Payne’s (HP) implied volatility that day was 29.0%, and TechnipFMC’s (FTI) was 26.0%.

Energy stocks are typically correlated with crude oil prices. Has NOV’s correlation with crude oil increased? Let’s find out in the next part of this series.