BTC iShares MSCI ACWI Low Carbon Target ETF

Latest BTC iShares MSCI ACWI Low Carbon Target ETF News and Updates

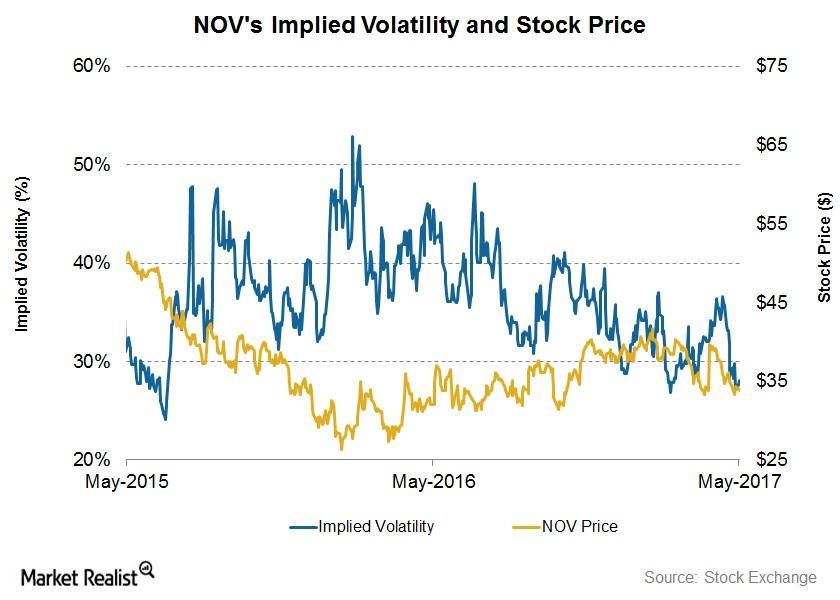

What’s National Oilwell Varco’s 7-Day Stock Price Forecast?

NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017.

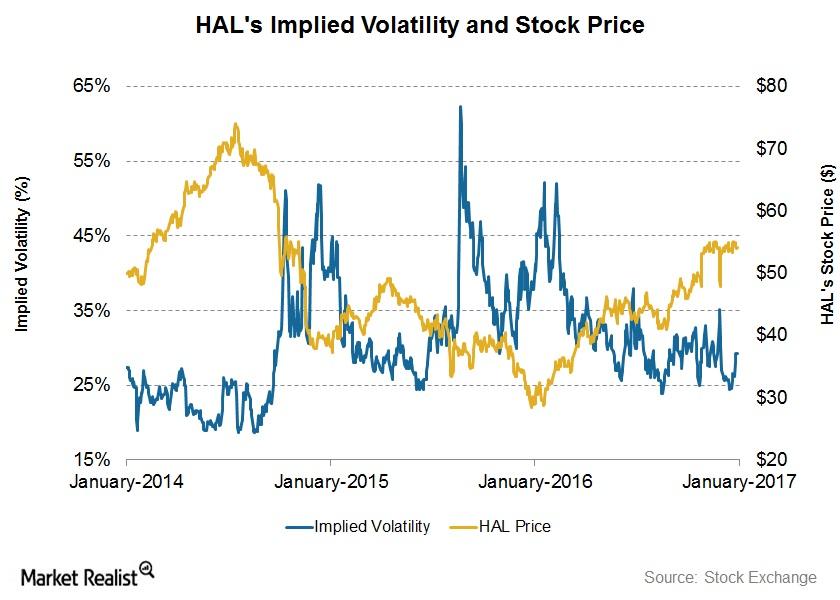

What Does Halliburton’s Implied Volatility Indicate?

On January 3, 2017, Halliburton (HAL) had implied volatility of ~29%. Since HAL’s 3Q16 financial results were announced on October 19, 2016, its implied volatility has remained nearly unchanged.

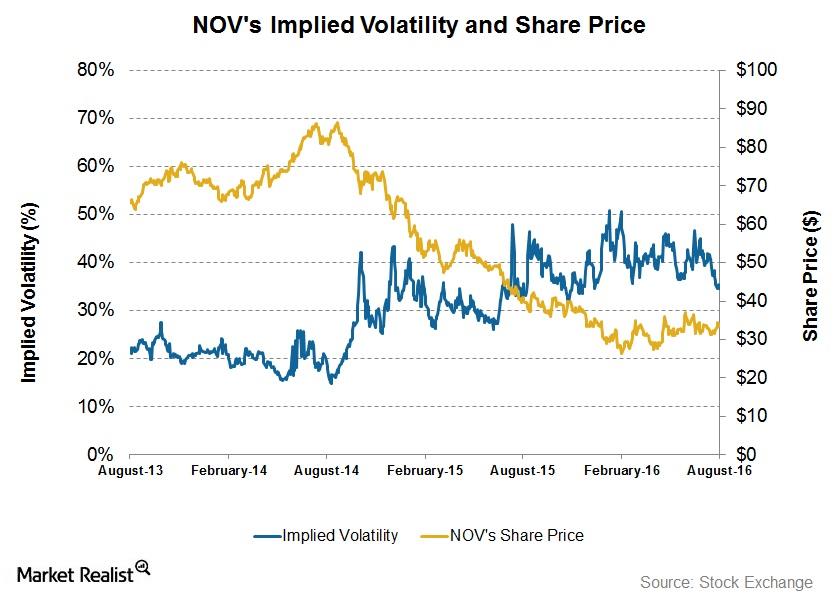

How Volatile Is National Oilwell Varco?

On August 16, 2016, National Oilwell Varco (NOV) had an implied volatility of ~35%.